The Turkish lira has been trading vigorously in the recent months and it has continued its robustness through August, although its performance has been far more impressive against the ultra-weak USD than against the basket (made of half USD, half EUR).

Against a favorable backdrop for continued yield-seeking behavior, TRY looks attractive for its cheap valuations (16% under-valued versus 10-yr REER average), CBRT’s commendable shift toward tight monetary policy and prioritization of financial stability, and the country’s diminished risk of political upheaval. November 2019 general elections provide motivation for officials to bolster economic momentum while keeping the currency stable.

The driving forces: Perpetuation of suppressed reflationary risks in developed markets support TRY as a high-yielding EM currency. A clear decline in locals’ appetite for accumulating FX deposits (some timid initial signs have appeared) could spark the next leg of the TRY rally.

Today's Q2 GDP data have produced upbeat numbers, and this could provide an additional near-term boost.

The Gross Domestic Product (GDP) in Turkey expanded 2.10 pct in the second quarter of 2017 over the previous quarter. The market consensus was around 1.8% GDP increase for Q2 following the 1.4% QoQ of Q1; we see the likelihood of a positive surprise to this number.

What is more, manufacturing data for July were also solid: the huge 15% YoY number was all base-effect from last year's coup, but even excluding this effect, output increased by a solid 2.3% MoM, which confirms that Q3 had a good start.

Meanwhile, the PMI has reached a multi-year high 55. All this points to room for further lira upside, at least in the near-term; the medium-term outlook of course remains clouded by disappointing inflation developments.

Risk profile: Due to elevated external vulnerabilities (e.g. high external debt to GDP, the high proportion of short-term liabilities, current account deficit), Turkish assets are susceptible to selloffs in developed market assets such as US Treasuries. Lapses in the tightness of CBRT liquidity policy could undermine the central bank’s new-found and still-tentative policy credibility.

Options Strategies (USDTRY):

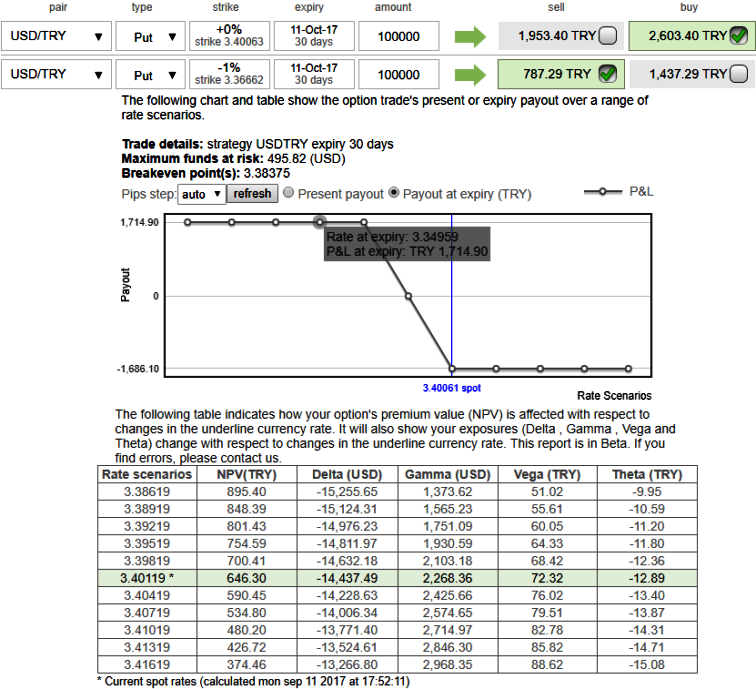

The conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short (1%) OTM Put with lower Strike Price of similar tenor with net delta should be at -0.14.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Alternatively, aggressive bears can bid USDTRY 1% OTM strikes of naked put with mid-month tenors.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation