Sterling OTC FX functions seem to be tepid, out of the limelight but underlying spot movements haven’t been out of the woods. Amid the consolidation phase of GBPUSD, it has bottomed out at 1.1986 levels and bounced back to the current 1.3066 levels (i.e. shy above 9% in just six and a half months).

After all, the so-called “Brexit bill” had already caused tensions ahead of the negotiations.

Still, it remains to be seen whether the two sides can agree on the size of the bill. The situation remains difficult for the GBP, however, as the recent reports of domestic political quarrels in the UK show. Chancellor of the Exchequer Philip Hammond had a few concerns during the weekend that some cabinet members were undermining his efforts to ensure a “soft” Brexit.

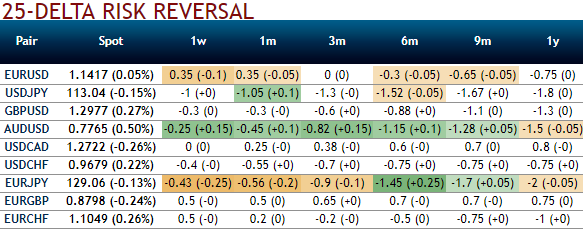

Despite this driving forces of cable, the 25-delta risk of reversals of GBPUSD have not been indicating any dramatic shoot up nor any slumps but bearish neutral (no fresh change in risk reversals has been observed), but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

The risk reversal curve has been traveling in a linear direction, while spot curve is slumping downwards back to converge with the RR curve.

Brexit has hurt eventually no matter if it is going to be soft or hard exit: If we do see resilience for Sterling through 3Q, as UK data hold up, and if we also see the euro trade down to parity with the dollar over that timescale.

While the cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBPUSD butterfly is now less expensive than the EURUSD butterfly, which is unsustainable given the GBP extra tail risk.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand