Prices remain under pressure, with the 1.30 psychological region and 1.2950 channel support below there already looming. US employment and the USD is likely to be the driver in the most part today, but a move back through 1.32 is needed to check this current trend lower and suggest a broader correction. While under, we still target a move towards 1.28, with the risks rising for a deeper move through there.

Long term, our studies suggest the bear trend that started back in 2007 at 2.1160 is in its last phase. Recent price action increases the chance that 1.1490 was a major long-term low.

Trade mechanism: Buy GBPUSD 6m bullish seagull strikes 1.25/1.38/1.41 Zero cost (Indicative, spot ref 1.3270).

This structure has almost no theta between the current spot and the 1.40 region during the four first months.

As it is zero cost and a very low theta means almost no convexity, it, therefore, behaves like a spot trade during this period in this region. The payoff, however, provides protection against a spot falls down to 1.25. The maximum profit amounts to USD3m if the traded notional is GBP100m per leg.

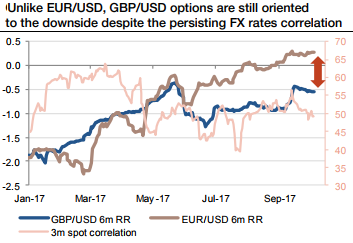

Options still skewed to downside Unlike EURUSD options, cable options are still pricing more implied volatility in the event of a lower currency (refer above graph).

The risk reversal curve remains fully skewed to the downside, especially for longer maturities. These diverging expectations are especially striking in a context whereby there is a strong correlation between EURUSD and GBPUSD.

We fundamentally view asymmetric odds in favour of the topside case, and this highlights the current cheapness of GBPUSD OTM calls. Even so, there remains a risk of a return to the low 1.20s and possibly a re-test of said spike lows in the next two years.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?