Euro area politics continue to be in focus with a Le Pen Presidency in the French elections the main concern, but so far the casualty has been the bond market in addition to the FX markets.

Fluidity in French politics continues to offset the strong Euro area economic momentum, putting downward pressure on yields. We update the scenario analysis for the French elections in light of recent developments.

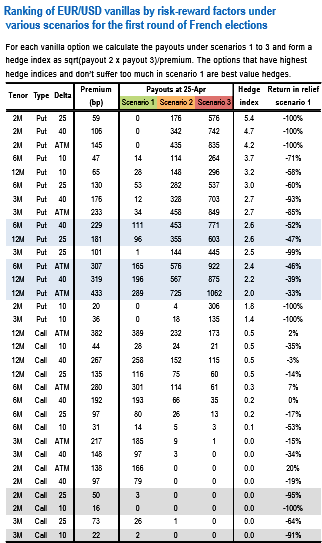

A scenario of moderate market stress with either Le Pen or a unified left candidate achieving a 30%+ score, vs either Macron or Fillon (or the “Republicans” candidate called in replacement).

In alternative scenario: The acute market stress in a confrontation between Le Pen and a Hamon/Melenchon coalition. Regardless of the probabilities of occurrence of each scenario, we make simple arbitrary assumptions for each scenario in terms of market impact in order to rank the efficiency of vanilla.

Let’s not glance through the above nutshell that inclines the probable performances of various EURUSD options on 25-Apr under these broad scenarios and reports their “hedge index”, defined as the geometric mean of the payout/cost ratios under above-mentioned scenarios (the “bad” ones), as well as their payout/costs under the “relief” scenario of an umbrella of scenarios perceived as benign, where Hamon and Melenchon do not present a unified radical left candidacy, the judiciary and public opinion pressure on Fillon abate and either 1) both Macron and Fillon qualify, or 2) either Le Pen or the left wing candidate gather less than 30% of the vote to face either Macron or Fillon.

Naturally, 2M puts are the most straightforward downside hedges, however, their all-or-nothing nature means that they become worthless if the outcome is benign.

To retrieve the highest hedge index while losing only in moderate proportion on a relief spot rally, one needs to scroll down the list to 6M 40D and 1Y 25D puts. The latter do offer better risk/reward than 1Y ATM puts, which explains why 1Y put spreads disappoint.

On the other hand, 3M 10D puts rank lowest among put options, and 3M 10D calls would deliver the worst overall performance under the considered scenarios.

Interestingly, this ties up with the observation we made regarding the performance of fly vols around Brexit, where we had found that 1Y flies outperformed 3M flies.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close