FX markets are back to a mild "risk-off" mode, with EUR leading the move as Italian budget issues continue to weigh. European Commission head Juncker yesterday warned of a Greek-style crisis when discussing Italy’s budget. The EU meet on the 15th October to decide on their actions in this regard. Italian 10-year yields have accelerated higher, causing German 10-year yields lower along with the EUR. Meanwhile, the Conservative Party Conference has so far failed to increase optimism around Brexit. Headlines suggesting a compromise around the Irish border issues saw GBPUSD stage a sharp but brief rally, with prices back to supports. Boris Johnson is talking at a fringe event, with the risk his comments may cause some market volatility, while PM May makes her key address tomorrow.

Elsewhere, last night's agreement in principle to update NAFTA under the new banner of the US-Mexico-Canada Agreement (USMCA) may yet contain some surprises buried in its fine details. But, similar to the immediate investor response, we are breathing a sigh of relief this morning. The deal is far from perfect, but other, decidedly more negative potential outcomes – such as Canada's exclusion from a revised agreement, a "zombie" NAFTA, and steep tariffs on Canadian auto exports to the U.S. – have likely been avoided.

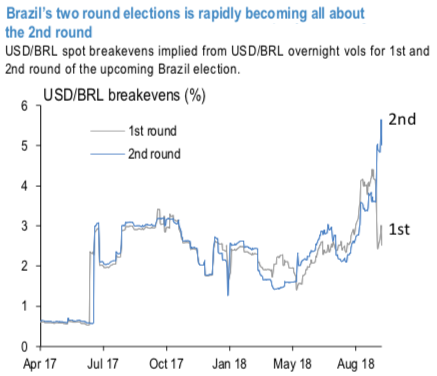

On the other hand, the modest pricing of the upcoming Brazil elections from earlier in the year has been replaced by viciously bid up election overnights (120vols). It mirrors the results we have had in the local polls (Ibope and Datafolha for example), which suggest that PT candidate Haddad’s momentum has improved and that he seems most likely to face candidate Bolsonaro in the 2ndround on October 28th(Brazil 2018 election: Haddad now takes the lead against Bolsonaro in the runoff simulations). ATM vols for the 2ndround have also adjusted and gained an upper hand on 1st round election vols (refer 1stchart), and as the election remains very uncertain, USDBRL 10/28 overnights may increase to levels last seen in 2018 Mexico election and Brexit referendum.

Fade 1stround vol via outright short gamma and low-cost calendars: With the focus rapidly shifting toward the 2ndround as likelihood of a surprise outcome is quickly evaporating it is tempting to consider a low cost benign outcome BRL topside trades that are able to take advantage of the post 1stround vol roll off. One such construct is a calendar spread.

Short front vs long longer expiry of EURJPY calls, USDJPY calls and USDMXN puts proved to be fruitful in the case of 1stround of French election, the US and Mexico elections, respectively (refer 2ndchart). Equivalent GBPUSD calls calendar and USDTRY puts calendar ended up costing only the premium in the case of the Brexit referendum and Turkish election. Courtesy: JPM, Lloydsbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -65 levels (which is bearish), while USD is flashing at 103 (bullish), while articulating at (11:10 GMT). For more details on the index, please refer below weblink:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data