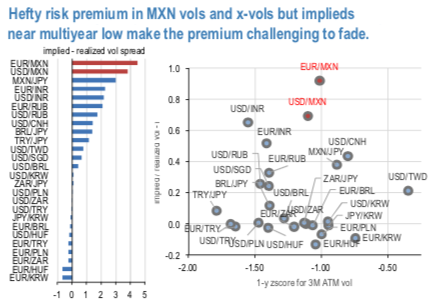

MXN realized vol is at historically low levels, resulting in eye catching MXN and x-MXN implied – realized vol spreads within the EM space (4.5vol and 3.8vol for EURMXN and USDMXN, respectively). Despite the hefty risk premium (refer 1st chart), with the implieds at multiyear low we prefer cautious constructs that monetizes vol smiles premium instead of outright vol shorts. 2m realized spot- vol correlation plunged as August rolled off from the 2m trailing window while 25 delta OTM MXN puts / ATM remain 1-sigma extended (1-year z-score basis).

Further expected policy easing by Mexico’s central bank and limited regional data will probably have the overall region more influenced by spillover effects from global developments over the coming week.

Banxico is expected to cut its overnight rate by another 25bps on Thursday.

It is analysed that earning theta without taking left tail risk via high beta ratio call spreads. Such structures are covered to a fair extent against spikes of high beta volatility given the long risk-reversal sensitivity embedded in the structure. Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years (refer 2nd chart).

Consider: 3M EURMXN ATM/25D 1*1.5 vol ratio call spread @9.45ch vs 10.5/10.75 indicative.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread @9.4ch vs 10.45/10.65 indicative. Courtesy: JPM

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One