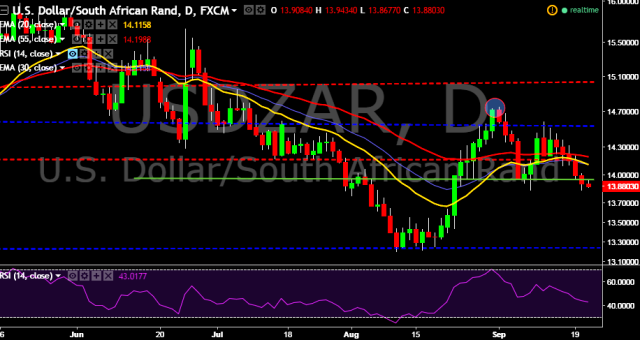

- USD/ZAR is currently trading around 13.87 levels.

- It made intraday high at 13.93 and low at 13.86 levels.

- Intraday bias remains bearish till the time pair holds major resistance at 14.21 levels.

- A daily close above 14.21 will take the parity higher towards key resistances around 14.32, 14.52, 14.68, 14.96, 15.05, 15.28, 15.45, 15.66, 15.77, 15.86(February 29, 2016 high) and 16.15 marks respectively.

- Alternatively, a daily close below 13.90 will drag the parity down towards key supports at 13.65, 13.38, 13.19, 13.00, 12.82 and 12.58 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- South Africa will release CPI as well core CPI data at 0800 GMT.

We prefer to go short on USD/ZAR only below 13.83, stop loss at 14.21 and target of 13.65/13.43.