After having risen sharply to 24.8459 around end-June because of the Brexit vote, USDCZK has slipped all the way back towards its 23.7740 floor over the past two months. Meanwhile, CNB has refrained from extending the timeframe of the FX floor (from the present mid-2017) nor debated negative interest rates at its last board meeting.

The central bank appears content with the progress of the economy and inflation so far. The CB is having to intervene actively again to defend the EURCZK floor.

FX reserves rose sharply during the first half of August. Part of this was from EU fund inflow, but even after accounting for this, the rise is sharp, which points to greater FX intervention as the likely cause.

Speculative inflows may be expected to pick up as we near the timeframe for exit from the floor mechanism unless of course, CNB were to announce offsetting monetary policy measures such as negative interest rates.

The base case remains that inflation will fail to pick up materially and that CNB will end up pushing the exit beyond 2017, and will also introduce negative interest rates by the end of 2016. This latter prospect, however, will depend on what central banks around Europe, the ECB in particular, do in the meantime. As of now, we expect further monetary easing from them.

Hedging Strategy:

Technically, we could foresee more scope for bullish momentum in intermediate term of USDCZK, from last three weeks regained the strength amid the growing expectations of hawkish moves by Fed in rate hikes; it takes strong support at 21EMA before the current attempts of jump above 7DMA which is a signal of bull run continuation in the days to come.

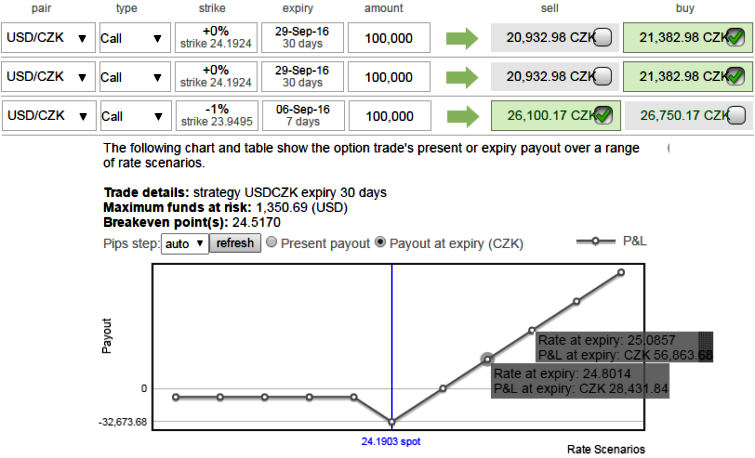

Hence, as shown in the diagram, hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) with comparatively shorter expiry in the ratio of 2:1.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cashflows. One can observe the rising positive cashflows as the underlying USDCZK spot FX keeps spiking on the higher side.

Even though the lower strike short calls appears little risky, if IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal