JPY appreciated and USDJPY marked 104.66 on March 26, but JPY reversed its course in the following period; JPY has lost 2% in NEER terms and depreciated against USD by about 1% during the period. On net, JPY has become one of the underperformers among majors during the period.

The early appreciation of JPY was attributable to uncertainties around the US politics and PM Abe scandals, and the Nikkei index lost 4% during the relevant period. In the following period, although markets’ concerns for trade wars between the US and China and Syria developments persisted, risk sentiments have recovered and JPY has become increasingly insensitive to developments related to the political risks.

The major downtrend of USDJPY since October 2017 that has turned reverse from mid-March. The pair has been spiking higher from the last 5-weeks considerably from the lows of 104.629 to the current 108.990 levels.

But remember never buck the major trend, the bearish USDJPY trend scenarios are projected upto 95 levels if 1) global investors’ risk aversion heightens significantly, 2) Prime Minister Abe steps down and 3) Trump administration starts vehemently criticizing Japan’s trade surplus against the U.S.

Dear readers, before proceeding further into the core part of this article, we urge you to glance through below weblink where we advised 3 leg options strategy for hedging optimally.

Well, As USDJPY was well-anticipated spikes and has significantly risen from the lows of 104.629 levels to the recent highs of 110.036 levels amid the major downtrend, we’ve already advocated diagonal put ratio back spread about a fortnight ago.

For now, short leg (ITM shorts) of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

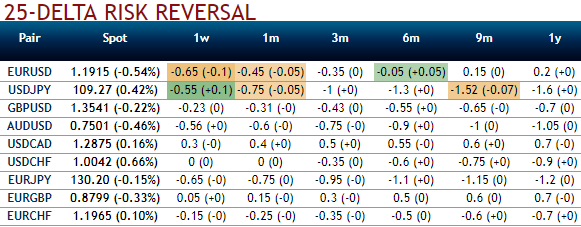

The positively skewed implied volatilities of 2m tenors signify the hedging sentiments for the further downside risks, this appears to be conducive for put option holders.

This bearish sentiment is substantiated by the bearish neutral risk reversal (RRs) numbers, negative RRs indicate the mounting hedging sentiment for the bearish risks appears to be intact.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 110.036/108.388 (2 lots), (vanilla: 0.75%, spot ref: 108.990). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of OTM put.

Currency Strength Index: FxWirePro's hourly JPY spot index has shown 148 (which is bullish), while hourly USD spot index was at 15 (neutral) while articulating at 07:37 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation