The FX markets are once again focussing on yield differences. The Mexican peso also had to find out about that yesterday and as a result of the yield rise of US Treasuries to above 3.0%, it depreciated significantly against the greenback, with USDMXN rising above the level of 19.00. And the NAFTA negotiations could not provide much support for MXN, even though the negotiations generally seem to be making good progress. Even US President Donald Trump has been sounding unusually conciliatory in this respect recently. It nonetheless remains unclear whether the negotiations will not be put on ice until the end of the year after all – i.e. after the Mexican Presidential elections in July and US Congress elections in November.

The recent 180 degrees turn in the NAFTA negotiation has resulted in a sharp U-turn in market sentiment vis-à-vis MXN and the upcoming Mexico election even as AMLO's win seems very likely. USDMXN overnight (O/N) implied vol for the July 1st event has plunged from 110 vols to 65 vol, the lowest Mexico.

Election Day weight since last July. Admittedly, with the currently solid prospects for a positive breakthrough in the NAFTA negotiations, a major market risk is being removed. Nevertheless, 2.7% breakevens (which is FX options markets pricing of an anticipated USDMXN spot move on the election outcome) seems modest. While on the back of the NAFTA breakthrough markets may have gotten comfortable with AMLO win, a growing tail risk of AMLO getting a simple majority in Congress remains.

Therefore, the vol market has not yet priced in the uncertainty related not only to the presidential election but also the Parliamentary elections that are occurring on the same day on July 1st.

The analyzed profitability of trading FVAs around elections and found that the ratio of 1M FVAs (start date set at around 1 week before event risk) to ATM vols is a good metrics for estimating profitability. Namely, if the ratio is > 1.5 FVA is a sell and vice-versa FVA is a buy when the ratio is below 1.5.

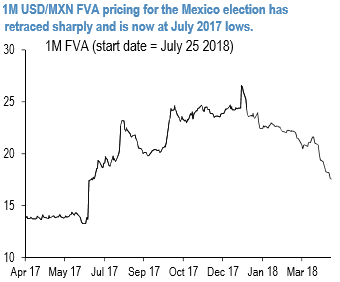

At the current market, USDMXN 1M FVAs mid with the start date set to June 25 are priced more than 8 vols below the January cycle high and come at a modest 1.3X ATM vols (refer above chart) implying a good value in owning election vol to hedge the residual election risk. With overnight pricing commanding a punchy bid/offer, the equivalent pre-/post-calendar spreads (selling pre-event options and buying post-event options in order to isolate and capture sharp spot moves/realized volatility) are worth considering.

We recommend buying 12-week USDMXN ATMF straddles @14.75/15.25 financed by selling 8 week straddles @12.95 choice. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand