AUDUSD in near terms: The pair began to build positive momentum, for a move towards 0.7200 if risk averse shocks remain at bay.

Medium term perspectives: AU-US yield differentials have continued to grind steadily in the US dollar’s favour in recent weeks, but the 10-year spread widening in early October was eye-catching, from around -32bp to -50bp. This appeared to be the major driving force of fresh AUDUSD lows since Feb 2016, near 0.70 levels.

Growing concern over the impact on China’s economy of US antagonism also seems to be weighing on AUD, while local politics remains a concern into the 20 Oct by-election. This implies medium-term risks towards 0.68. However, Australia’s key commodity prices are substantially higher than early 2016, so trade sub-0.70 might be fairly short-lived.

OTC outlook and Hedging Perspectives (AUDUSD):

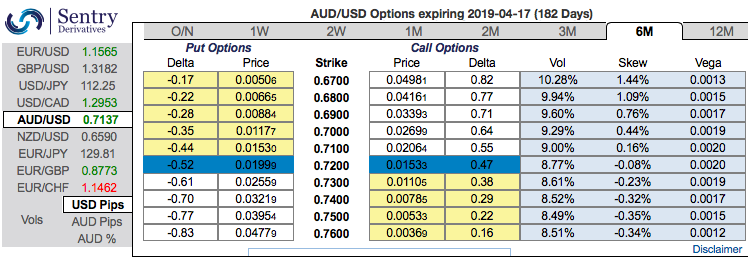

Before proceed further into the strategic framework, let’s quickly glance through the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.67 levels (above nutshell). While positive shift in risk reversals are in sync with momentary upswings in the underlying spot fx, bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks.

Accordingly, we have advocated delta longs for long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1w tenors, theta shorts in short-term to optimize the strategy (as shown below).

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit.We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying.

The execution of hedging strategy:Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 6m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Currency Strength Index:FxWirePro's hourly AUD spot index is inching towards 54 levels (which is bullish), hourly USD spot index was at -40 (bearish), while articulating (at 07:06 GMT). For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data