The US 10Y Treasury yield slipped from its four-year high of 3.03% to 2.98%, with most of the move occurring before the ECB decision. 2Y yields nudged higher, from 2.47% to 2.49%, to help flatten the curve. Fed fund futures yields continued to price the next rate hike in June as a 100% chance.

Despite new multi-year highs in Treasury yields for some sectors, focus in U.S. rates markets was squarely on the curve and going forward, the swap yield curve slope is increasingly exposed to more idiosyncratic factors via the term structure of swap spreads.

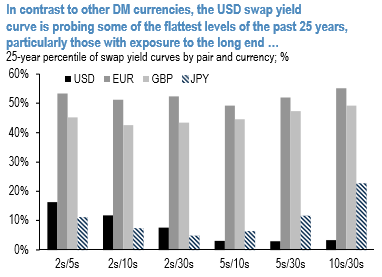

Though the recent re-pricing of the yield curve has not been particularly disorderly, its proximity to inversion has generated significant focus. This is certainly not unique to the U.S., but is more pronounced relative to other currencies (refer above chart). That is not to say flat curves are unprecedented, particularly if one adopts a global perspective. Starting with a simple historical comparison, the 2s/10s USD swap curve, for example, has been inverted for nearly 6% of the past 25 years while in GBP this was true nearly one-quarter of the time over the same period.

A key risk factor to our stance is the potential role of exotics hedging flows. Because certain types of payoffs — e.g., non-inversion and other range accrual notes — contain embedded binary optionality, rapid changes in the convexity profile of these exposures can lead to very disorderly rebalancing flows as dealers manage their exposure.

This has been an important consideration in the past for U.S. rates. That said, the stock of such exposures in USD notes is considerably smaller than was the case in 2006, reflecting a more narrow set of both investors and issuers, and the leverage of those exposures is much lesser as well.

These flows also only tend to arrive in force when the curve is meaningfully inverted, rather than right around zero.

Therefore, while potentially a driver of the swap yield curve for short periods of time, we expect neither a large nor a sustained impact on the swaps curve from exotics-related hedging. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch