Amid the June Bank of England MPC vote split in which three members voted for an immediate rate hike and the recent flurry of speeches from officials, we have yet to hear from Deputy Governor Ben Broadbent.

At the other extreme, markets are now pricing a higher than 90% chances of a Bank of Canada rate hike next week, and that has helped CAD to be the only G10 currency to outperform the US dollar. Falling oil prices have had little impact but the rise in bond yields reduces the relative appeal of AUD and NZD, G10’s highest yielders.

Markets are waiting on central bank speakers for more clues on prospects for global interest rates. The principal focus is on tomorrow, with Chair Yellen testifying to the House and the possibility that the BoC may raise rates. While comments from the BoE’s Broadbent would be meticulously watched today on whether he might be inching towards higher rates, even though he voted for no policy change in June.

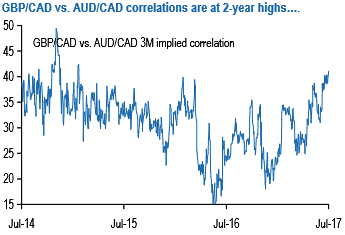

CAD-denominated correlations have jumped recently alongside the collapse in USDCAD. The loonie had been screening cheap to cyclical correlates such as rate differentials and oil prices till a couple of months back, but that is no longer the case after the 5.5% appreciation of the currency since mid-May.

With BoC monetary policy now priced at par with the Fed over the next year, our macro strategists are of the view that further re-pricing of the CAD rates strip and the currency will be difficult to achieve from here, which in turn should also arrest the upward momentum in CAD-correlations.

As per the JPM, within the universe of CAD-corrs, GBPCAD vs AUDCAD screens as the most expensive (refer above chart), which is fortunate because it is one of the few CAD-based pairs where selling correlations have generally been a profitable exercise.

Realized correlations are clocking 5-10 points above implieds using a 1-month lookback, but are showing some signs of cooling over the past week (implied correlation 1M 44, 3M 39 vs. 1-wk daily WMR realized 32, 1-mo daily WMR realized 56), so we should not be far from optimal timing into corr. swaps and/or delta-hedged option triangles.

These are transaction cost and/or operational management heavy, however, hence our preferred expression is a non-delta-hedged combination of three vanilla options –short GBP calls/CAD puts, short AUD puts/CAD calls and long GBP calls/AUD puts – where: i) the long/short option orientations are consistent with a short correlation stance, and ii) strikes and notionals on the cross leg (GBPAUD) are determined by those on the two short legs such that the ‘delta loop’ is closed i.e. has no net directional exposure at inception.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts