NOK’s bullish streak took a breather over the past month as the performance was temporarily weighed down by equity market volatility.

NOKSEK has been reputable with new cycle highs this week despite inflation undershooting in Norway by more than it did in Sweden (two-tenths versus one-tenth).

The reason: the Norges Bank has indicated its preparedness to tighten policy in response to the recovery in the real economy whereas the Riksbank has tied policy normalization to an improvement in inflation irrespective of what the real economy is doing.

It has been yet another dismal month for SEK, which has underperformed all other G10 currencies since our last publication a month ago and also year-to-date.

As discussed in our recent posts, the recent weakness has been driven by more dovish stance by the Riksbank motivated by modest misses in inflation alongside a weakening in activity data, and temporarily further exacerbated by weak seasonals related to repatriation of annual dividends. The recent move has set new benchmarks for the currency. EURSEK has made fresh 8-year highs and the trade-weighted index is testing its lows over the same horizon.

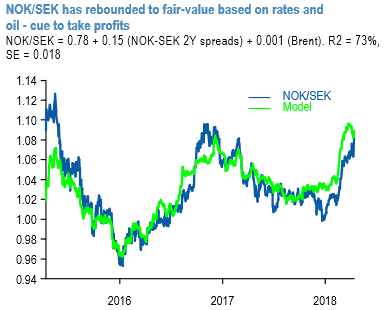

Further out, the inflation prints matter far more for SEK than they do for NOK in the days to come, especially in the Norges Bank's case when the break-out in oil prices will further increase its confidence in prospects for the economy. That being said, we are taking profits on the NOKSEK call spread that was partially funded by selling an EURSEK put because:

1) The spot is closing in on the high strike of the spread;

2) NOKSEK is now fairly valued on a model basis (refer above chart), and

3) EURSEK is overshooting by close to 7% relative to rate models and the Rikskbank’s own forecasts, which increases the risk of a retracement at some point. These are good levels to exit both NOKSEK and EURSEK, albeit we keep a core structural short in EURNOK.

Trades recommended:

3m NOKSEK 1.066/1.092 call spread vs short EURSEK 9.95 put for 0.20% on March 2nd. Booked at 1.27%.

Shorts are to be upheld in EURNOK spot at 9.4960 that were advised in mid-March. Marked at -0.77%. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential