Stable NOKSEK is anticipated: Both the NOK and the SEK will continue to appear to investors as an attractive alternative to the European currencies.

But they should offer quite limited relative value opportunities, despite the 1% spread between the two central banks’ main rates.

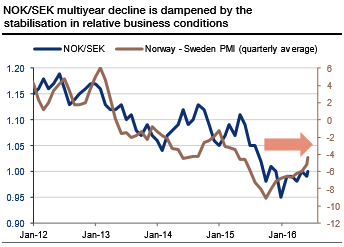

The NOKSEK has been actually driven by relative business conditions in Sweden and Norway and the differential is now clearly stabilizing (see graph).

Nevertheless, NOK has been catching up with consolidating crude oil price patterns. Norwegian interest rates are very closely correlated to oil prices, so the FX/rates link implicitly embeds the sensitivity to the commodity complex as a core driver.

Not only is the NOK lagging the oil bounce and likely to catch up, but we anticipate the prices to stay firm given the contraction of US production and robust global demand.

This suggests a continuation of the range bound trading regime for the NOKSEK cross.

The pair after testing resistance 1.0136 seems slightly edgy and moving in sideways but looks stronger on monthly as leading indicators converge to the price spikes.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate