We raise 4Q’17 oil price forecasts by 4.50/bbl on Brent and $1/bbl on WTI to reflect the tighter balances now forecast, to $54.50 and $50.00/bbl, respectively.

Similarly, for 2018 we raise Brent to $47/bbl, and WTI to $43.25/bbl as we shift the assumption about how long OPEC-NOPEC will sustain production through to the end of 1Q'18. This keeps us bearish outright pricing, versus current spot and futures values, implying better value for producers to hedge output than for consumers to hedge fuel costs.

Yet, here again, we are reminded that the risks to the base case remain elevated, with geopolitical risks higher now than in many quarters. Moreover, market participants have had the luxury of ignoring risks presented from supply disruptions, while the market wrestled with oversupply and rapidly building inventories. Now that stocks are falling, such issues could come to grab the market’s attention. If the tail risks from either:

Iran, (possible new US sanctions),

Iraq (Kurdish secession risks prompt a suspension of exports from Turkish ports), or,

Venezuela –social situation deteriorates and production declines accelerate past that warranted by a lack of sufficient investment,

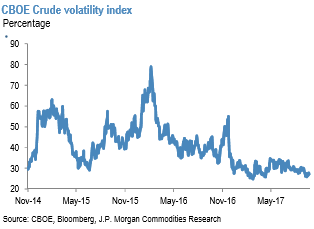

were to become the base case, prices could react in a manner that seems incongruous to a market with implied volatility trading close to three-year lows, (refer above chart).

The re-balancing is a result of strong consumption and also due to efforts led by the Organization of the Petroleum Exporting Countries (OPEC) to cut output by around 1.8 million barrels per day (bpd) in 2017 and the first quarter of next year. U.S. production hit 9.55 million bpd in late September, its highest level since July 2017 and not far off its 9.61 million bpd record from June 2015.

Geopolitical risks are higher now than for several quarters. The possibility of renewed US sanctions on Iran, the risk that Turkey may interrupt Kurdish exports on the back of increased secession risks and the continued social problems in Venezuela could all tighten markets in the short term. Moreover, market participants no longer have the luxury of ignoring risks from supply disruptions that oversupply and rapidly building inventories provided.

While we now assume that the OPEC deal will conclude at the end of 1Q’18 rather than the start, the big picture remains broadly unchanged from the views expressed in the 2017 outlook. Essentially, we continue to expect the OPEC deal to support prices in the short term, but we retain reservations about the implications for supply growth from higher prices, once the deal is unwound.

For further market guidance, it is worth keeping an eye on inventory data from the U.S. Energy Information Administration (EIA), which is due to be published later on Wednesday.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?