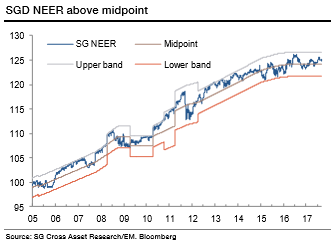

It is believed that SGD would be a regional underperformer and should be used as a funding currency. The chance of the MAS tightening policy is very low and instead we assign a 70% chance that the midpoint of the SGD NEER will need to be re-centered over the coming years.

The economy will likely remain mired in a low growth and low inflation environment due to:

1) The downside risks to Chinese growth in 2018,

2) The weak productivity and slow growth in the labour force,

3) A muted consumer credit cycle,

4) The weakness in property price, and

5) The reduced inflow of foreign labour.

Key drivers: As long as the EUR remains bid, the USDSGD will creep lower. However, assuming the MAS does not tighten in October and Chinese growth starts to slow, the SGD NEER should settle at the bottom of the band.

Risks: Surprise hawkish rhetoric or a tightening of policy (i.e. moving to an upward slope) would shift the SGD’s dynamics to that of an outperformer.

In EM Asia, we hold OW MYR and short USDSGD. Skew: KRW has high skew and high skew-to-vol (call spreads offer attractive discounting for dollar bullish views) – these metrics are very low in SGD and CNH. Convexity: Butterflies are expensive in KRW and cheap in CNH, SGD, TWD, INR, in our view. Use 1m debit put spreads for USDSGD downside risks.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch