The most recent South African economic data was not exactly constructive: the unemployment rate rose to over 27% in Q3 and the inflation rate also rose to 6.4% in October. That means it has eased only slightly against its high in February of 7% and remains stubbornly above the central bank’s target corridor of 3-6%.

The South African Reserve Bank left its benchmark repo rate on hold at 7 pct at its November of 2016 meeting, as widely expected.

Policymakers said growth in the third quarter is expected to be positive, but below the level of June quarter, while left the GDP forecasts unchanged from September. The inflation reached to an 8-month high in October, after food prices picked up the most since 2009 due to severe drought, but it is expected to moderate in early 2017.

The bank also noted the rand will be sensitive to changes in the stance of the US monetary policy.

The central bank (SARB) now seems to be increasingly stuck between a rock and a hard place in the shape of the weak economic data on the one hand and the increased depreciation pressure on the rand on the other.

After all, in its October report, it expected the rate of inflation to return into the target corridor in the second quarter of 2017.

However, the biggest risk in this context is the rand. In addition to global factors, it is mainly the political uncertainty in South Africa that is putting pressure on the rand as well as the risk of a rating downgrade.

We firmly maintain our bearish stance in ZAR, with the South African rand screening as exorbitantly priced versus the dollar, even as the domestic political story has suffered a meaningful shift. The rand now appears to be pricing in “positive" political risk premium, as recent events have weakened President Zuma’s position and increased the chances of a “regime change”.

The current market price action differs from previous political episodes, where USDZAR has frequently priced negative political risk premium related to risks that Finance Minister Gordhan could be dismissed.

FX Option Strategy - Diagonal Call Spreads (DCS):

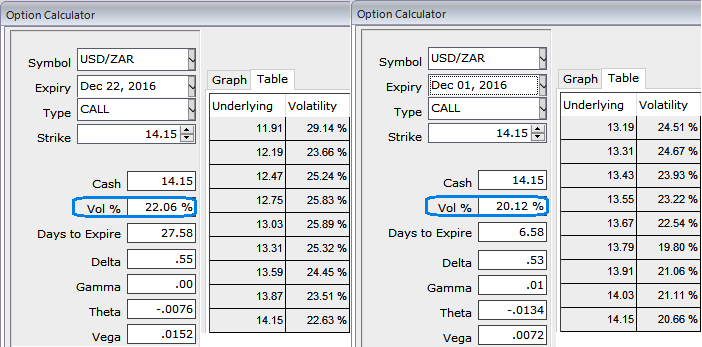

Hence, we upheld the long positions in USDZAR in option spreads, cash trades were not preferred on account of high yield IVs, 1m ATM IVs are spiking shy above 22% from 20% in 1w tenor which is a good sign for option holders.

Anticipating further price upswings in the underlying spot of USDZAR, on hedging front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

In a naked vanilla form, we suggest credit call spreads types at the 1M horizon but with a diagonal tenor pattern, optimizing strikes for leverage. In USDZAR, the 1M-2MATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly. One could initiate their option trades as shown in the diagram, but use appropriate strikes and tenors as per the requirements.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close