As the U.S. Federal Reserve is most likely to maintain status quo at its monetary policy meeting today due to pauses to parse more economic data but may hint it is on track for an increase in June, bullion’s both spot and OTC markets have been highly active today.

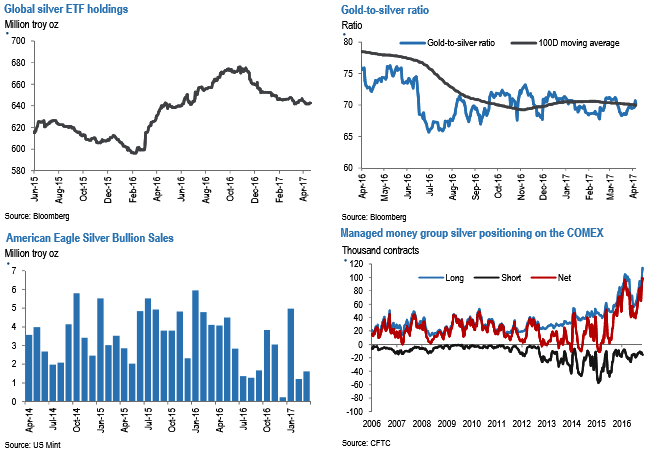

Turning to silver more specifically, following the mid-March Fed hike, silver prices outperformed gold into the end of the month, more than doubling the return of gold in the second half of March at around 8%. This sent the gold-to-silver ratio from about 71 down to below 68.5by the end of March (refer above diagram).

However, with silver largely ranging between $18/oz and $18.60/oz so far in April and gold moving another roughly $30/oz higher, the ratio has rebounded back up above 70.25 on silver underperformance.

In terms of investor flows, money managers have added more than 35,000 contracts of net length in COMEX silver over the past three weeks ending last Tuesday (April 11). This propelled their net long position to more than 98,800 contracts long, edging out last July to mark the longest level since data begin in 2006 (refer above diagram).

Particularly relative to investor positioning in gold which at around 140,000 contracts net long is roughly half the level it peaked out at in July 2016, silver length appears stretched. However, if last year is a guide, the silver net length did not exactly wash out lower after peaking in July 2016. Instead, it took about three months to bottom out at around 40,000 contracts net long.

Unlike the recent boost in investor length on the COMEX, total ETF holdings of silver have remained lackluster and range bound, roughly trending between 642 and 648 million ounces since the beginning of March (refer above diagram).

In terms of physical demand, higher prices likely led to lower sales of American Eagle silver coins so far this year. In the first quarter overall, sales declined by 47% yoy according to the US Mint, however, March sales were up 33% mom (refer above diagram). Furthermore, precious metals consultancy Metals Focus contends that while price likely played a role in subdued investor demand it might not be as weak as the US Mint’s numbers indicate.

Overall, investor demand on the COMEX has primarily driven silver prices higher so far in 2017 with ETF demand and physical investment appearing lethargic from the 1Q data we have. While questions still remain about how much additional physical demand will come from industrial sources this year, particularly photovoltaic installations after huge growth in 2016, we maintain our view expressed above that macro precious metals drivers like rates and FX will ultimately guide the price of silver in 2017.

To conclude, while silver prices could be maintained in the coming weeks on lingering risk-off sentiment around the French elections and other near-term catalysts, they will likely adjust lower into the second half of the quarter on higher US yields.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says