Tension is simmering within the UK government. After Defense Secretary Michael Fallon suddenly had to step down last week, Secretary of State for International Development Priti Patel was ordered to return to London during a trip abroad in a surprise move due to allegedly unauthorized talks with other countries. She was asked to resign. The conflict within the government and the obvious lack of control May has over her Ministers is not making the negotiations with the EU, which will be resumed today, any easier.

How is a country going to negotiate in a unanimous and unified manner to the outside if within the ranks government members are tearing each other to pieces?

As a result, the downside risks in GBP continue to dominate, above all if disappointing economic data is added to the mix.

Hedging framework via options strategy:

Central bank events are delivering: BoC and ECB have been at the vanguard of reshaping non-US rate expectations this year, and their easing up on policy normalization rhetoric in October sparked good-sized spot swings in the immediate aftermath of meetings.

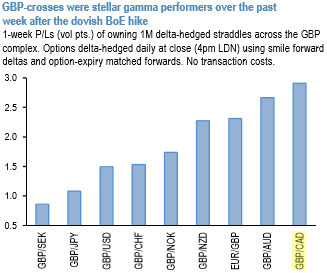

BoE was the latest to join the band of market-moving central banks this past week after its dovish hike pounded the sterling and led to solid gamma gains across the GBP-complex (refer above chart).

The outcome was not entirely unpredictable: it has been noted in the recent past that the mix of near-complete discounting of the November rate move, a heavily priced hiking cycle (100bp) along the Gilts strip and weak data flow in the build-up to the meeting in the context of Brexit uncertainty had raised the odds of sell-the-fact price action in GBP.

While the GBPCAD has been oscillating between a price range of 1.7165 and 1.6350 levels from the last two months with more potential on the downside. According to this price behavior, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.6682, initiate long in GBPCAD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1%) out of the money call with positive theta. The short leg with narrowed expiry likely to reduce total hedging cost.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -80 levels (which is bearish), while hourly CAD spot index was at shy above 37 (bullish) while articulating (at 09:03 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics