No doubt, the prevailing minor trend of NZDJPY has been bullish, NZDJPY bulls spike well above DMAs coupled with healthy bullish momentum and bullish DMA & MACD crossovers, the uptrend likely to prolong in the near terms.

However, as we foresee that this pair to breach recent ranges to the downside in 1H’18, and forecast the currency at JPY 74.500 by mid-2018. From there, it is reckoned that the currency should settle at USD 72.427 levels by the year-end.

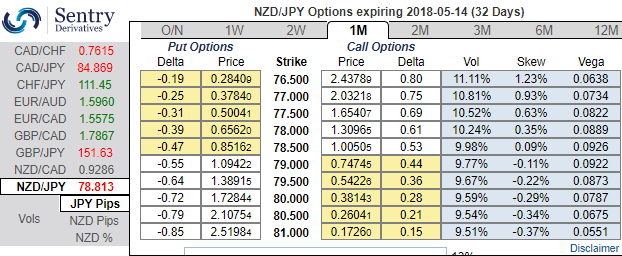

ATM IVs of NZDJPY is trending above 10.30% for 1m tenors and positively skewed IVs of these tenors are also indicating bearish hedging interests. Bids for OTM puts upto 76.50 is noticeable to signify the downside risks which is almost in line with our above-stated projections.

We don’t think many of these factors will be too different in throughout 2018, as a result, we could still foresee scope for underperformance from NZD in the year ahead.

The Kiwi is expected to lose its pole position at any time in terms of offering the highest central bank policy rate in G10 next year, and this should keep the currency a laggard. Moribund milk powder prices should also continue to drag on the currency.

NZD has been one of the poorly performing G10 currency against USD in 2017. A combination of weaker-than-expected economic growth, tighter funding conditions, slowing net immigration and a change of government all conspired to relegate NZD to wooden spoon territory last year.

Accordingly, earlier we had advocated debit put spreads, contemplating the recent developments we wish to convert them to credit put spreads, conservative hedgers can still prefer the old strategy:

Credit Put Spread: As shown in the above diagram, one can initiate longs in 1M (1%) OTM -0.37 delta Put + Short 1m (1%) ITM Put with higher strike price with net delta should be at -0.27. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OTM strikes.

The following table indicates how your option's premium value (NPV) is affected with respect to changes in the underline currency rate. It will also show your exposures (Delta, Gamma, Vega, and Theta) change with respect to changes in the underline currency rate. This report is in Beta.

At a net debit, bull put spread reduces the cost of trade by the premium collected (on the shorts of ITM put) and keeps option trader to participate in upward moves and any abrupt downswings.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 107 levels (which is bullish), while hourly JPY spot index was at -63 (bearish) while articulating (at 06:46 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential