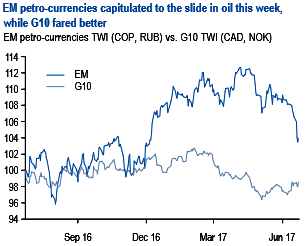

The slide in oil prices has intensified since WTI crude dropped from $52 levels, consequently, oil driven currency crosses seem to be edgy as Brent down another 5% to its 8-month low. The decline in oil prices over the past month had initially primarily impacted only G10 Petro-currencies but the negative momentum finally spilled over into EM Petro currencies this week.

RUB was the primary casualty (-3% vs. USD) followed by COP (refer above chart). The dollar meanwhile has broadly strengthened versus most currencies this week although a surprisingly less dovish stance by certain central banks resulted in some divergence (NZD and NOK outperformed).

The valuation divergence has continued to persist in commodity currencies with NZD and AUD still screening rich vs CAD and NOK. Valuations of Petro-currencies are still near fair value (refer above chart), but still depressed from the long-run point of view.

CAD and NOK appear similarly near fair value but continue to appear quite cheap relative to Antipodeans, where valuations are still rich. NZD is the richer of the two currencies and appears richer-still given the outperformance in the past month.

Both currencies continue to face further downside in this framework as well in our forecasts, especially vs EM high yielders as discussed in prior publications.

These recent cross-currents are also emblematic of the offsetting medium-term forces that keep USDCAD relatively bounded in our quarterly forecasts. The first is revised expected profile of WTI crude prices, after the recent developments from OPEC. We now expect WTI crude prices to firm towards $53/bbl into year-end on the recent OPEC supply agreement, but then for prices to drop notably towards the $39-41/bbl range in 1H’18. Against this, is the expected forthcoming start of BoC policy normalization, for which recently our economists pulled-up the forecasted start to 2Q’18 from 3Q’18. Canadian rates are pressuring the USDCAD again, irrespective of the recent oil turmoil.

Options trades:

Long 08-Dec-17 USDRUB call (59), spot ref: 57.00.

Buy EURUSD vs. EURPLN vol spreads and sell EURNOK – EURSEK correlations, consider medium-term [EURUSD↑, EUR/EM↓] dual digitals.

We’ve already advocated USDCAD trades in our recent write-up, we uphold buying 2m put strike 1.27 KO 1.23 @ 0.17%, vs 0.37% for the vanilla.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes