As the ECB edges towards normalization, an undervalued euro has room to rise further, but let’s not isolate the factor, instead glance through below driving forces of euros:

Bullish euro scenarios: 1) The ECB changes guidance in March, heralding an end to QE in Sept and hikes by 1Q’19. 2) Growth sustains above 3% into 2H’18. 3) Concerns about the US twin-deficit intensify.

Bearish euro scenarios: 1) EUR appreciation delays ECB policy normalization (change in QE guidance delayed until April). 2) Growth relapses to 2.0-2.5% 3) Eventual repatriation by US corporates-EUR accounts for a third of foreign profits.

Pairing EURUSD vega longs against EURRUB shorts largely immunizes the spread against European political risk.

There is also a case to be made for the long leg to be comprised of a mix of EURUSD and a petro-sensitive EUR-cross such as EURCAD to strip out the oil price sensitivity of the structure.

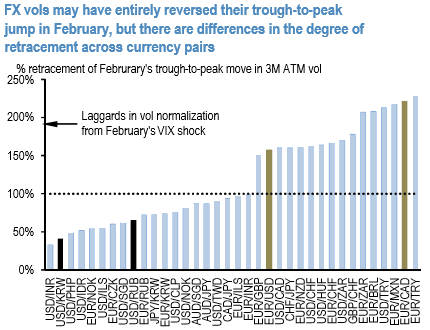

EURCAD vols also have the advantage of very little risk premium priced into them having reversed more than 100% of their VIX-spike gains per above chart, and can also potentially benefit from idiosyncratic NAFTA-related stress.

We initiate an equally weighted basket of 6M EURUSD and EURCAD straddles (€85K vega each) vs. selling €100K vega of 6M 30D EUR calls/RUB puts.

The RV is better expressed in longer expiries (6M – 1Y) than in short dates since the implied –realized premium in RUB widens as one goes further out the curve, and also because the belly of the curve is the best value sector of the EURUSD surface to buy.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 33 (which is bullish ahead of ECB monetary policy meeting today), while hourly USD spot index was at -32 (bearish), CAD is flashing at -76 (bearish) while articulating at 06:34 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed