In between recovery rallies of Kiwi dollar we stated to use any dips for shorting in Call Ratio Backspreads in our previous posts (higher IV favored writers), it has shown their effects and is now heading again for attempts of recovery as both technical and fundamental indications are signaling buying sentiments.

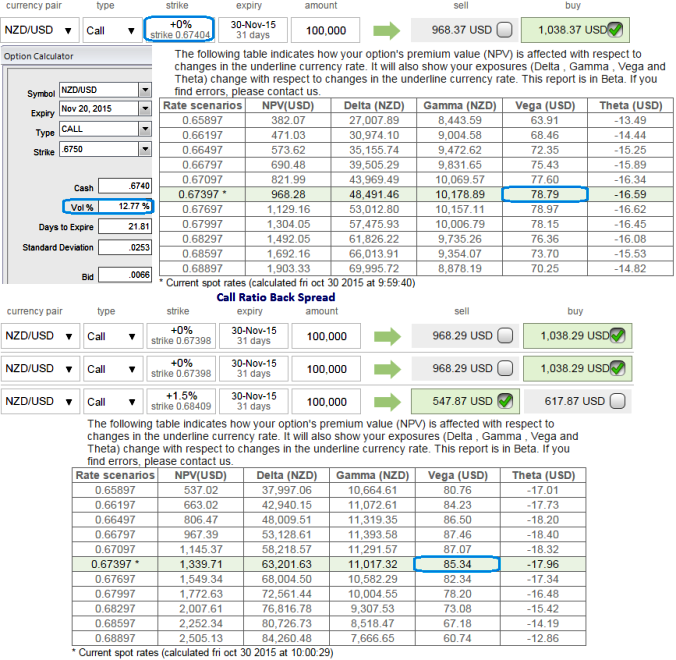

The current IV of NZDUSD call is reducing to 12.77% from 14.59% which is good for option holders, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the below stated option prices are directly proportional to the implied volatility.

Vega on Long ATM Call = 78.79 which has increased from earlier flashes when advised call back spreads.

So in this case Vega both on long position is reasonably acceptable.

Risky traders can still initiate shorts in this ITM call with positive theta but ensure shorter expiries on the same as it is desirable that at maturity the underlying exchange rate of NZDUSD to remain near short strikes in order to achieve highest returns.

Hence, we recommend it is better to cover all your shorts and as shown in the diagram purchase 1 ATM call and (1%) OTM call and simultaneously short 1 lots of ITM call with shorter expiry in the ratio of 2:1.

The lower strike short calls because it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for no cost or a net credit.

FxWirePro: Reducing vols with rising Vega good news for NZD/USD call holders – shorts in CRBS still an option for risky traders

Friday, October 30, 2015 5:15 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate