RBNZ to stay on sidelines. There are therefore cross-currents buffeting the growth outlook next year, but the impact on 1H 2018 is likely to be the net negative. Inflation should consequently remain contained despite the 4.8% rise in minimum wages in April 2018. The government is also reviewing the RBNZ's mandate with the intention of inserting "maximum employment" as a second mandate alongside price stability and moving to a committee structure for monetary policymaking. The RBNZ is therefore expected to stay on the sidelines through 2018 in the face of the institutional changes and countervailing fiscal effects.

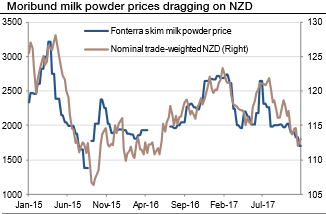

NZD underperformance to persist. The Kiwi is expected to lose its pole position in terms of offering the highest central bank policy rate in G10 next year, and this should keep the currency a laggard. Moribund milk powder prices should also continue to drag on the currency (Graph 2). The AUDNZD's gradual upward trajectory remains on track, but the NZDUSD will be supported by the US dollar's secular decline.

OTC Outlook and Options Trade Recommendations:

Let’s glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be lowering southwards as the skews have been flashing positive numbers on OTM strikes upto 0.67 or below.

Please noted that the 1% out of the money puts of 1m tenors are exorbitantly priced over 21.6%, whereas this pair has been no exception from low vols environment, 1m IVs are just shy above 7.8%. Hence, the option premium of this OTM put is deemed as the overpriced instrument. Lower IV environment while rising underlying spot sentiments would be conducive for option writers of such overpriced puts. Hence, it is wise to snap rallies to deploy shorts.

Accordingly, at spot reference: 0.7179, since the 3m skews are targeting OTM put strikes at 0.67, we’ve recommended put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

Hence, the strategy reads this way - writing 1m (1%) in the money put with positive theta snapping decisive rallies, you could easily make out short legs on OTM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% ITM puts, the structure could be constructed either at net debit.

Theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 18 levels (which is neutral), while hourly USD spot index was at 133 (highly bullish) while articulating (at 07:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data