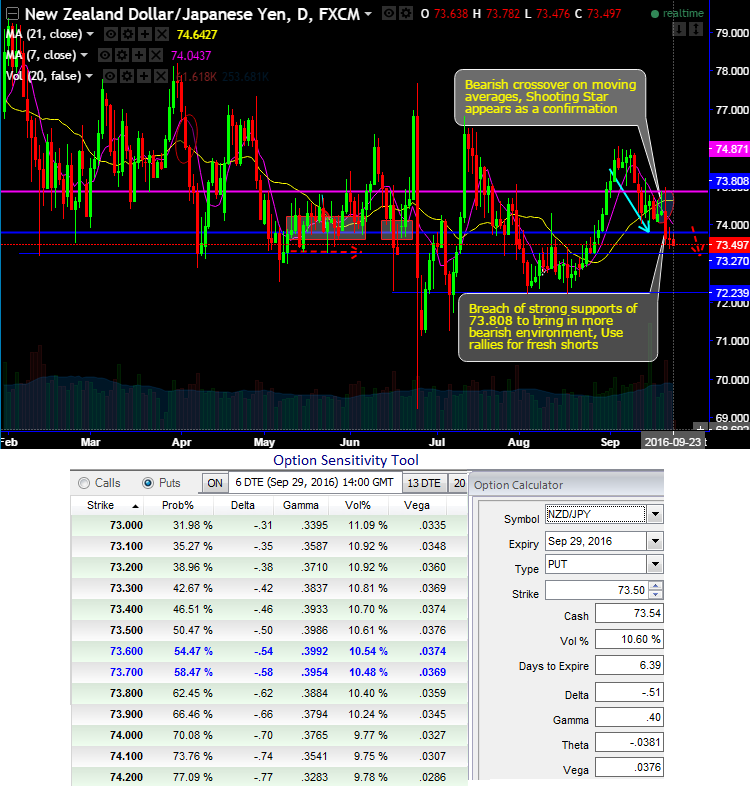

Dear readers, we had explicitly specified in our previous post to expect more dips up to the next support only at 73.272 levels and upon breach this level, bears may even drag up to 72.239 levels again, and it seems like heading towards that direction southwards.

Well when it comes to the RBNZ and RBA, the answer is probably not a great deal. The former is taking policy lower, but in a measured fashion, while the latter appears relatively comfortable with its policy settings as they currently stand. Comments from both were more or less consistent with market pricing.

Yesterday, RBNZ stays pat in its monetary policy, leaving the OCR unchanged at 2.00%, which is in-line with the market expectations. The statement acknowledged the economic developments since August and the NZ dollar has risen more than expected. After the central bank’s Market pricing for a November OCR cut has risen to around a 70% chance.

Hedging Framework:

The IVs of NZD crosses are extremely volatile even after RBNZ’s monetary policy, especially the current IVs of 1W NZDJPY ATM contracts are trading at 10.60% and likely to perceive on an average of 10.5% across all OTM put strikes that would divulge pair’s weakness (see 1W-1Y ATM IVs). While vega on the OTM put strikes are comparatively higher that signifies the sensitivity of an option’s value to a change in volatility.

So, buy 2W ATM vega put and (-0.5%) out of the money vega put option of the same expiry and simultaneously short 1W (1%) in the money call option.

In this instance, let’s visualize in 1weeks’ time NZDJPY keeps drifting southwards from current levels of 72.239 or stay stagnant or even spikes but certainly not above (1%) within 1 week, then ITM shorts would expire worthless and likely to fetch you the certain yields.

But, remember to have the reasonable Vega of a long put option position, because these HY IVs will have the predominant role in option premiums if it increases or decreases by 1%, the option’s premium will proportionately increase or decrease by respective vega values.

Here, by employing 1W ITM call writing in our strategy is an extra advantage in hedging cost and to match both higher implied volatilities and delta risk reversals.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand