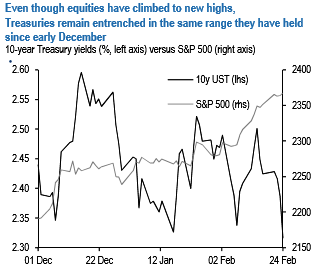

Treasury yields have remained stuck in the same range they have held since early December, even as equities have continued to rise and are now up 5% YTD (refer above diagram). In the recent times, UST yields initially rose on the back of Yellen’s semi-annual testimony before Congress, as well as a higher-than-expected CPI report, which led us to pull forward our projections for this year’s rate hikes to May and September versus June and December previously.

While the fundamental backdrop looks strong, domestic and foreign political risk remains. Although positions have moved closer to normal over recent weeks, any further reductions in the short base could pressure yields lower, so we remain neutral on duration at current levels.

Although the treasury secretary Steven Mnuchin said this week that he is earnestly considering 50-or 100-year debt, we continue to think the scope for adding either maturity point is limited.

At the risk of repetition, the long end continues to be dominated by the ongoing unwind of variable annuity hedges. Though there has been some offset receive fixed flows owing to long-end financial and Formosastyle callable supply, as well as the extension of outstanding callable, their liability durations remain significantly lower than pre-election levels adjusted for these effects.

This should keep long-end spreads somewhat directional with rates. We, therefore, recommend overweighting the Bond somewhat when initiating wideners in this sector. Based on their recent empirical relationship, we recommend buying current 30s versus paying fixed in 90% duration risk of matched-maturity swaps.

Options volatility has been offered across most of the surface, with the gamma sector underperforming longer expiries. The expiry curve in 10-year tails has steepened along with the decline in volatility. As of Friday’s close, ATMF vols on 3-month, 1-, 2-, 3-year expiries were down 2, 1.6, 1, and 0.5 a bp, while 5-year expiries were roughly unchanged and 10year expiries were up 0.4 a bp over the past two weeks.

The relative performance of the vega sector owes in part to a somewhat lighter than expected vol supply in February. After a record-setting January which saw nearly $12bn of issuance ($28mn per abp24 in dollar vega risk), we estimate approximately $5bn ($8mn per a bp) hit the tape so far this month.

In part, we believe this reflects some front-loading of demand, as Taiwanese life insurance companies looked to add shorter-lockout deals before new regulations become effective later this year25).

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan