The general parliamentary election is held on Sat 23 September. Polling ends at 7 pm NZT, and the results of most votes will be available that evening. Polls have indicated a close race.

NZ goes into the polls and having fallen by 3% or so since a change in leadership for the opposition Labour party ushered in a much tighter contest, we believe it prudent to take profits on NZD short:

1) NZ First has slipped in the opinion polls and may fail to command a kingmaker role in potential coalition negotiations, thereby neutralizing investors' anxieties at the possible influence NZ First could wield over immigration policy.

2) A victory for Labor would certainly usher in a period of institutional uncertainty for the RBNZ, given Labor’s preference for a dual mandate for the central bank, but there’s now a certain risk premium in NZD for this eventuality. A sharp additional drop in NZD on a Labour victory is not a foregone conclusion.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

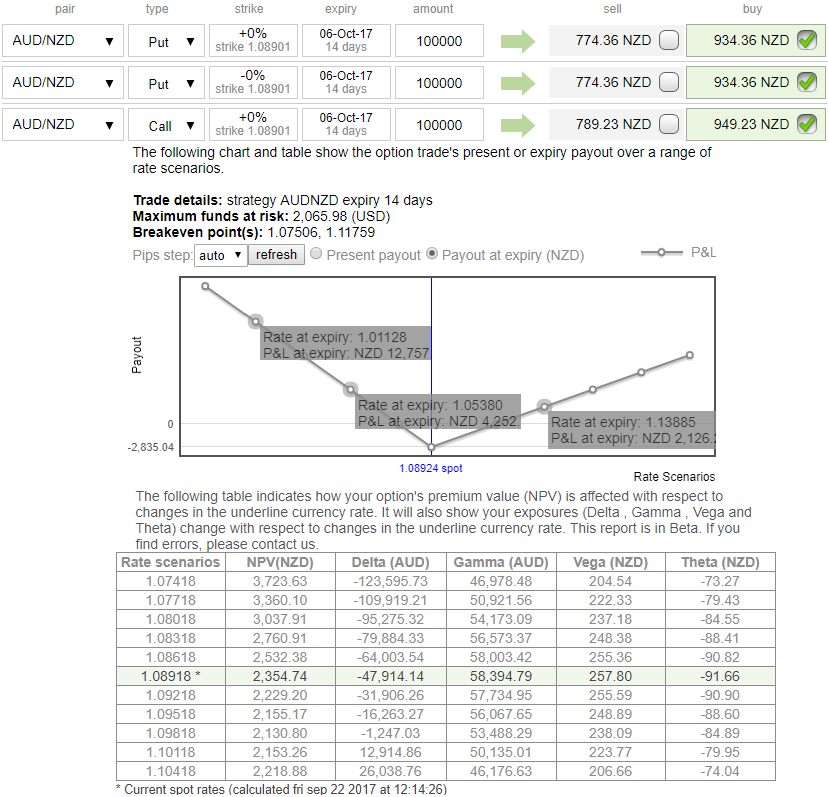

To participate in the recent bullish trend, we had advocated option straps strategy that contains 3 legs of vega longs (2 calls plus 1 put). Contemplating above fundamental political developments and the ongoing technical trend of this pair, we now wish to convert this strategy into option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

The execution goes this way: Initiate 2 lots of 2w longs in -0.49 delta put options, simultaneously, add 1 lot of +0.51 delta call options of the similar expiry, the strategy is executed at net debit. As shown in the diagram, the strategy is likely to derive positive cash flows but with more potential on downside. Maintain above shown option greeks in the positions.

Currency Strength Index: Ahead of NZ parliamentary polls, FxWirePro's hourly NZD spot index is flashing at -103 levels (which is highly bearish), while hourly AUD spot index was at shy above -32 (which is mildly bearish) while articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025