The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed since most of 2H’17. Sustained growth but still-soft inflation dynamics are ensuring that monetary policy normalization is a slow process so far, with limited risk of acceleration by central banks. The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock.

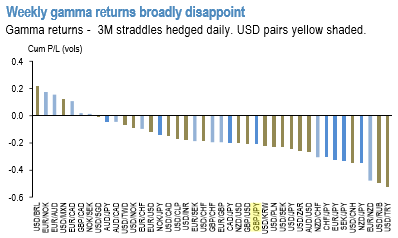

As a resultant effect of above-stated depressed and continued vols environment, FX gamma returns (refer 1st chart) suffered another week of pain as the busy calendar and fear from the US trade actions on the back of the Section 301 investigation report kept implieds supported but failed to revive realized vol (refer 2nd chart).

Moreover, April has consistently been the most FX vol downbeat month. That’s in part driven by vol supplying Japanese corporate hedging into new fiscal year that directly impacts back tenor yen and yen x-vol ultimately spilling over into higher beta currencies. The risk is that with the trade elephant still in the room, seasonal FX vol trends may be less notable this time around.

Since the onset of the trade protectionism theme a few weeks ago and amid potential for a major left tail risk event we have turned defensive.

Our lean remains defensive and we hold onto long cross-JPY vega in spread format (GBPJPY –USDJPY, BRLJPY – USDBRL), long EURUSD and EUR-cross (EURCAD) vol exposure and are short high dollar correlations (NZD vs. JPY) that should mean-revert lower if trade skirmishes intensify. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields