The implied volatility of ATM contracts for near month expiries of this the pair is at around 8.5%.

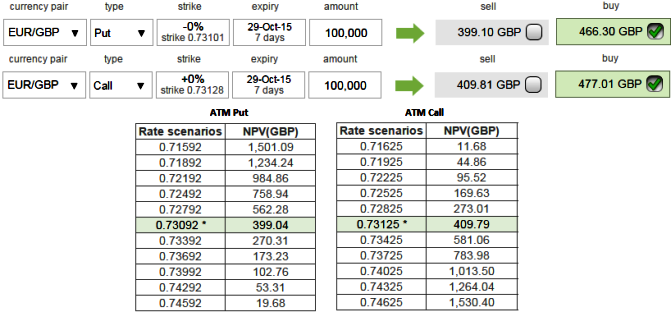

NPV of ATM call - 409.79 while Premiums trading above 16.40% at GBP 477.01 for lot size 100,000 units.

NPV of ATM put - 399.04 while Premiums trading above 16.85% at GBP 466.30 for lot size 100,000 units.

Hence, comparing this negligible difference in options premium with implied volatility and market sentiments we think the hedging cost would not be economical on upside as result of deploying ATM instruments.

But we cannot afford to get stuck in this riddle without hedging, so what's the alternative, in forwards markets at least..?, subsequently, here comes the strategy arbitrage strategy in which options trading that can be performed for a riskless profit as EURGBP ATM call options are overpriced relative to the underlying exchange rate of EURGBP.

To perform this conversion, the hedger holds the underlying spot FX and offset it with an equivalent synthetic short spot FX (long put + short call) position.

Profit is locked in immediately when the conversion is done, the profit would be strike price of call/put - purchase price of underlying + call premium - put premium.

FxWirePro: Option arbitrage for EUR/GBP as NPV of ATM calls indicates overpriced premiums

Thursday, October 22, 2015 9:47 AM UTC

Editor's Picks

- Market Data

Most Popular