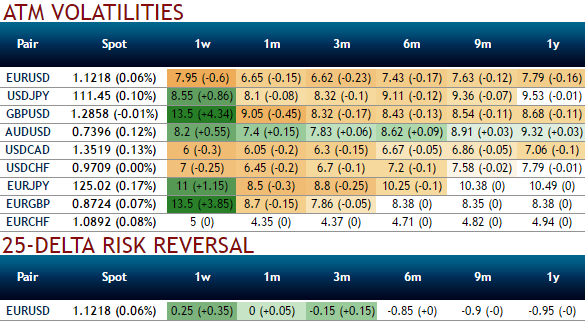

The EURUSD vols have been belligerently sold off in the aftermath of the French presidential election. The markets hailed the election of Macron, shielding a very pro-European programme. The majority of the risk was factored in at the front end of the curve, and the 1m implied returned to lows not seen since 2015 (refer above charts), which marks the start of the current vol regime.

Nonetheless, the longer EURUSD expiries like 3m and 1y vols fell significantly below their lows. This seems intriguing as volatility moves tend to be larger at the front-end. But the 1m vol did not break its lows because it is now pricing the next 8 June ECB meeting.

The last time the low vol regime lasted a certain amount of time coincided with a period when central bank policies were more accommodative than today. This depressed the volatility of short rates, which is powerfully driving FX volatility. We see more lingering hedging interests for downside risks (refer above charts).

However, we now observe a correlation break between FX and rates volatility, with EURUSD vol under pressure while rates vol remains supported. In our view, relative rates volatility currently better captures the central bank stances than EURUSD volatility.

The option strategy: Contemplating the above implied volatility of the pair, the costless collar option combination strategy is advocated at this juncture, and is established by buying a protective put while writing an out of the money covered call with a strike price at which the premium received is equal to the premium of the protective put purchased.

Costless collars can be established to fully protect existing long underlying outrights with little or no cost since the premium paid for the protective puts is offset by the premiums received for writing the covered calls.

Depending on the volatility of the underlying, the call strike can range from 30% to 70% out of money, enabling the writer of the call to still enjoy a limited profit should the stock price head north. This strategy is typically executed using LEAPS options as the striking price of the call sold can be rather high in relation to the price of the underlying spot FX.

Lastly, FX vol has been extremely focused on short-term political risk, and its valuation diverged from the medium fundamental background. As the market is now freed from political fears and refocuses on the modalities of ECB tightening, the case for more euro bullishness and more volatility resurfaces.

Thus, we advocated buying EURUSD topside volatility - EURUSD vol sold off aggressively after Frexit fears receded. The market will now focus on the ECB's 8 June meeting. FX vol has disconnected from rates vol, which has been less impacted by political risk but still resiliently discounts ECB risk.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data