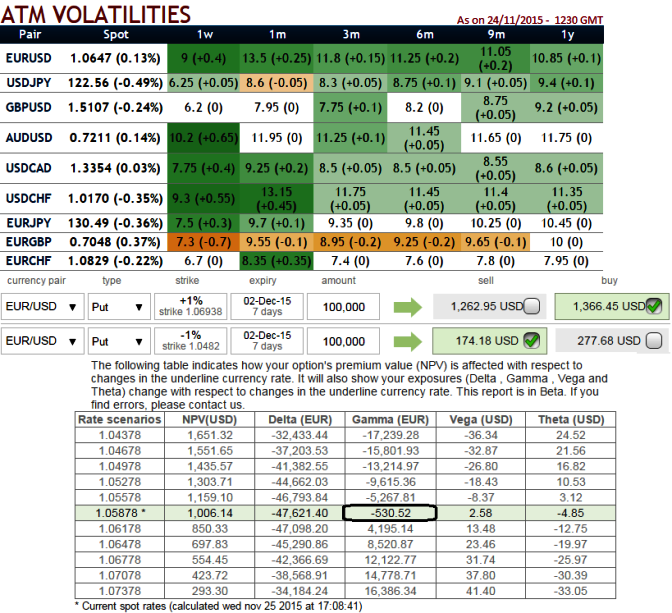

The implied volatility of the ATM contracts of EURUSD is spiking highest among G7 currency pairs amid the speculation on monetary policy decision by Fed. We see 13.5% vols for ATM contracts with 1m expiry which is the highest.

Hedging framework using naked contracts would turn out to be a gamble on those currency pairs whose implied volatility would be spiking up drastically (from the nutshell one can observe, EURO currency crosses except EURCHF are the ones whose IVs are increasing consistently).

Hence a lot of spreads have been drawing up some customized strategies by synthesizing both risk reversals and vols while looking upon the Option Greeks simultaneously. While doing so it seems like the FX options involving euro have tons of Gamma.

For an instance, we've considered EUR/USD's downside risks, and this can be mitigated by sparing little time on ascertaining an accurate gamma.

As you can observe from the diagrammatic representation, we've constructed put spread by considering gamma somewhere closer to zero that would neutralize the implied volatility impact on option price.

This position remains quite firm to achieve our hedging objectives (we've used price band between 1.0693 - 1.0482), because we know gamma represents the change in delta, we still have healthier delta at -0.47.

This spread results in desired hedging objective irrespective of implied volatility disruptions as we have both ITM and OTM instruments on long and short side respectively and prevailing bear run will be taken by In-The-Money puts.

Gamma of ATM options near expiry increases, whereas the Gamma of ITM and OTM options decreases. The chart below shows the behavior of Gamma relative to time until expiry and the option's moneyness.

FxWirePro: Optimize Euro implied volatility via gamma spreads

Wednesday, November 25, 2015 11:47 AM UTC

Editor's Picks

- Market Data

Most Popular