We already urged about October series of bearish streaks that could resume the sideways back on track.

Consequently, the dollar has begun the trading week’s extended gains at 1.0880 levels but euro holding firmly after last 3-weeks of bearish streaks.

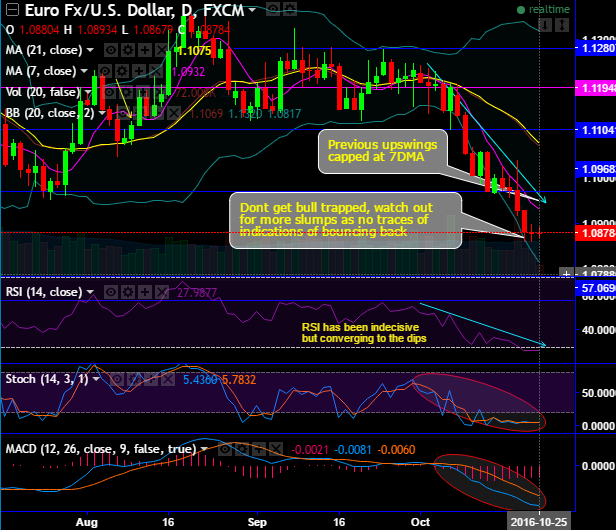

Despite the attempts of today’s upswings the current prices have remained well below 7DMA with bearish crossover on DMAs, while the major trend drifting through sideways.

EURUSD traded its tightest daily range in three weeks, consolidating above key support at 1.0800-1.0750. While above there, further range trading is most likely, particularly as momentum studies are relatively stretched.

To the topside, initial resistance lies at 1.0965/75, with a move through opening up 1.1040/50 and 1.1120. A break above these would negate the bearish sentiment and suggest a move to 1.1250-1.1400 range resistance is possible.

Long-term, we are suspicious that the 1.0450-1.17 range is developing as a “flag” consolidation ahead of a test of key long-term support in the 1.00-0.99 region. We are monitoring this for greater clarity/confidence, but for now, ranges persist.

Thereby, we conclude stating that the major non-directional trend likely to prolong further as bears resume after last month’s gains (see monthly charts).

RSI (14) on daily is converging to the current dips and being bearish bias. The environment has resulted in the selling momentum as this leading oscillator has approached oversold zone but no traces of bullish interests.

While slow stochastic curves are highly indecisive to signal clear trend direction as it there is no %K crossover.

On a broader perspective, we reckon that the pair from here onwards largely bearish and advisable to capture the current rallies to deploy shorts is a wise trading idea, then the next targets would be seen at 1.0780 levels in the days to come.

Long-term investors should be cautious, even if it holds the current levels, we see restricted upside potential at EMAs, at this juncture momentum in previous rallies likely to collapse; long term non-directional trend seems intact. Hence, in long run, we still project below cyclical lows 1.0780 but between the range of 1.06-1.11 by the Q1'2017 end.

Hence, we advocate not getting bull trapped, instead, watching out for more slumps as no traces of indications of bouncing back.