Last week’s unexpectedly weak US jobs data and subsequent cautious tone by Yellen has opened the door for gold to resume its bull cycle. However, Brexit could see the gold push towards USD 1,300/oz and above.

Yellen mentioned she expects the economic recovery to continue but gave no indications on the timing of a next rate increase.

In light of the signals from the Fed deferral policy and the recent economic data, we now look forward to the Fed to raise rates in September, followed by another move in December.

Gold price is highly responsive to the moves in U.S. rates, as a rise would lift the opportunity cost of holding non-yielding assets such as bullion.

Gold is up 19% so far this year amid skepticism over the Federal Reserve's ability to raise interest rates as much as it would like this year.

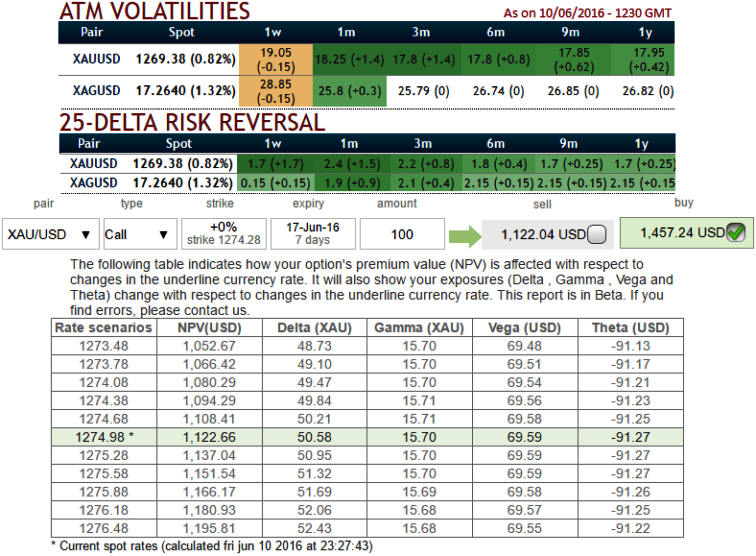

The implied volatility of 1W XAU/USD ATM contracts 19.05%, it is likely to stabilize above 17.5% in the long run. While delta risk reversals for 1w expiries are at positive 1.7 and likely to spike higher progressively at 2 for next 1-3m tenors These positive flashes indicate calls being relatively costlier than puts, which indirectly means that hedgers are more keen on upside risks.

As shown in the diagram, the premiums of 1W ATM contracts are trading at 29.80% more than NPV, hence, contemplating this disparity with risk reversal we think the opportunity lies in writing a call while formulating below strategy for gold's uncertainty at this juncture.

Margin: Not needed for Calls

How to execute: Capitalizing on the risk reversal numbers and above fundamental aspects, we recommend initiating long in 3M (1%) OTM +0.67 delta call option, and simultaneously short 1w (1%) ITM call with preferably positive theta or closer zero.

The Delta is continuously varying as the underlying spot FX fluctuates. Options further in-the-money (ITM) have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy trade walk-through:

One can use the above strategy upon trading the expectation that the underlying spot FX of gold would rise above 1% OTM in the long run. Even if it goes against, the maximum loss is limited by OTM strike price minus premiums received on shorts.

The impact of volatility factor: In next 1M ATM IVs are expected to shrink to 18.25% which is favourable 2w shorts, No significant effect is expected since we have the dual leg in our strategy.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?