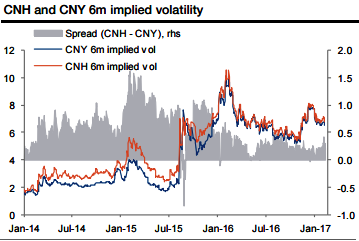

The options trades are preferable over forwards as the implied volatility is similar between CNH and CNY (CNH vol is 0.2 vol points higher than CNY vol in the 6m tenor) and the vol spread has been narrowing over time.

These conditions provide interesting option-based relative value strategies, where investors can enter zero cost structures (plus/minus a few basis points depending on spot, points, and vol) to position for the CNH-CNY basis flipping.

A notable advantage of the option strategy is that positioning for the basis to flip is contingent on RMB depreciation (topside strikes), whereas a position in forwards could underperform and has greater MTM risk if the RMB strengthens or is stable.

Our base-case scenario envisions USDCNY rising to 7.30 by the end of 2017. The structural richness of implied volatility over realized argues for short volatility structures. Additionally, short downside volatility is appealing because there are few fundamental reasons for the CNH to trade meaningfully stronger over the next year. Owning a 1yr USDCNH zero-cost seagull structures have consistently been advocated (6.90/7.20/7.50, zero cost) offers a maximum gain of 4.1%. With no digital risk involved and limited convexity, the position can be conveniently delta-hedged. Losses are unlimited if USDCNH trades below the 6.90 strike in one year.

The structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.90, exposed to a maximum USDCNH appreciation of 4.1% at expiry.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed