The British economy advanced 0.6 pct on quarter in the three months to September of 2016, slowing from a 0.7 pct expansion in the previous period and in line with the preliminary estimate.

With no significant data announcements except UK PMIs that could drive volatility in both FX option as well as spot FX markets. 1w ATM IVs of GBPJPY are a tad below 13%, we think these vols are not justifiable despite a quite data flow in both UK and Japan.

Sterling slips to its weakest since mid-November amid an ongoing absence of clarity on UK’s EU exit plans. While GBPJPY has been struggling to break the stiff resistances of 144.662 levels amid recent rallies bullish SMA crossover, more rallies seem likely upon breach above 144.662 (we’ve explained the importance of this levels in our technical post), but any sharp spikes in near terms seem unlikely.

Bank of Japan keeps policy unchanged, retaining a 0% 10-year JGB yield target. Global PMIs for December eyed; UK survey momentum is expected to remain solid.

However, the PMI has provided a first taster. The coming week’s UK PMI data (Tue-Thu) and BoE credit data (Wed) will provide further color on Q4 trends. Survey data for December so far – including GfK consumer confidence and our own Business Barometer – have seen improvements relative to November, but sharp movements in surveys since the referendum have generally tended to have little carryover to official estimates of ‘hard’ activity.

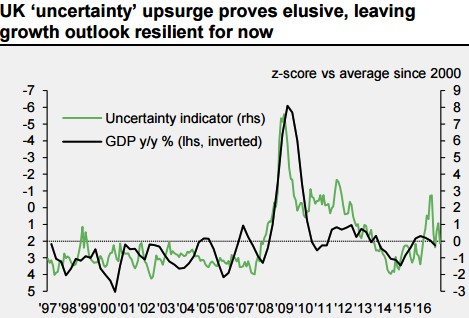

More broadly, with the post-referendum upsurge in uncertainty proving short-lived, the main drag on the economy is now expected to come through the hit to consumer purchasing power resulting from the weakness of sterling, with the bulk of the impact due to take effect in 2017.

In the recent times, GBP vols skews normalized too much after the Brexit votes, the GBP volatility market normalized sharply (you could observed that in GBPJPY IV skews) which is quite favorable for OTM option writers. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

Major downtrend and short-term upswings into consideration, anyone who wishes to carry long GBPJPY exposures, a collar options trading strategy is recommended. This could be constructed by holding a total number of units of the underlying spot FX while simultaneously buying a protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in a number of contracts.

The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence