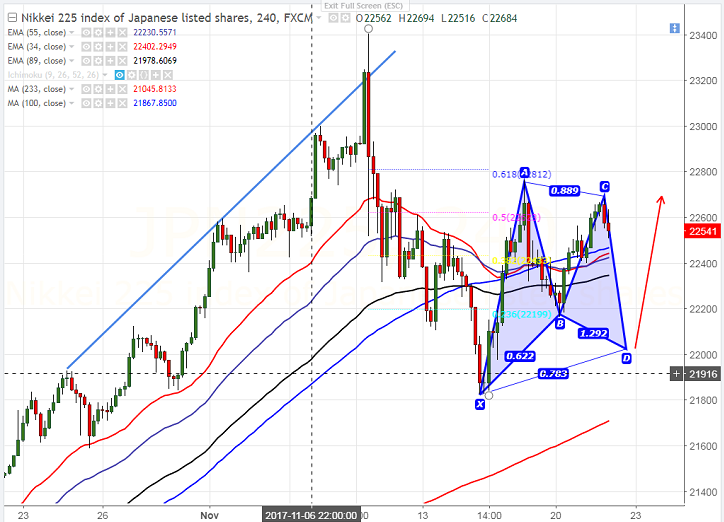

Harmonic pattern - Bullish Gartley pattern

Potential Reversal Zone (PRZ) - 22000

- Nikkei has once again slightly declined after hitting high of 22682 yesterday. The index is consolidating in narrow range between 21826 and 22766 for past one week after hitting 25 year high at 23423 on Nov 9th 2017. The index’s long term bullish trend mainly due to weakness in Yen and strong Global markets. The slight recovery in yen will drag the index down.

- USD/JPY has declined slightly after hitting a high of 112.72. The pair bullish continuation can be seen if it closes above 114.45 (161.8% fibo) level. On the lower side, major support is around 111.71 (100- day MA) and any close below will take the pair till 111.13. It is currently trading around 112.21.

- On the lower side, index major support is around 22343 (89- 4H EMA) and any break below will drag the index down till 22000/21750.

- The near term resistance is around 22800 and any break above will take the index to next level till 23000/23200/23480.

It is good to buy on dips around 22000 with SL around 21750 for the TP of 22800.