What a difference a month has made to GBP in terms of immediate central bank prospects, if not the cyclical outlook for the economy or the complex interplay between UK politics and Brexit. The BoE caught the market off-guard at its September MPR when it signaled its intention to commence tightening in ‘coming months’. The curve had assumed that the BoE would be on hold until early 2019. The result: a dramatic rate re-pricing -a November hike is now 75% priced and two full hikes are discounted by the end of 2018 -and a 5% short-covering scramble in GBP, its second-best monthly performance since 2009.

There are a number of challenges in translating a materially altered monetary landscape to GBP: There is still a lack of clarity as to what exactly has prompted the shift in the BoE’s reaction function as the MPC has offered partial and sometimes conflicting explanations for its abrupt change of heart.

Thus, a famous saying goes, never put all eggs into the single basket, we are currently running long GBP vol risk via a GBPCHF vs. EURCHF gamma spread where implied vols are well located near the bottom-end of a long-term range, the underlying spot prices are trading close to the middle of the recent 1.30-1.36 range. Our underlying bias is that the rebound from 1.30 is corrective for a move through 1.30 towards 1.28, potentially 1.25.

The vol spread has a desirable tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, enjoys a healthy positive carry at inception and is well-insulated from SNB shenanigans.

Given the timing unpredictability of twists and turns in the UK policy story, however, it is worth considering maturity diversification of a defensive GBP sleeve of trades via slightly longer-dated vol structures that also have the added advantage of slower decay than shorter-expiry options.

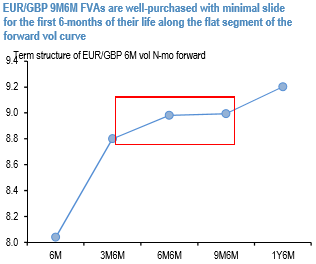

6M in 9M EURGBP forward volatility (9M6M FVAs) fits the bill, since it provides a 6-month runway of little/no static slide along a flat long-end vol curve (refer above chart), is marginally (0.5 vol) cheap on an RV basis versus equivalent GBPUSD structures, and has the additional kicker of participating in any Euro-related volatility brought about by either a more aggressive than expected ECB taper or resurgence of Italian election risk premium.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays