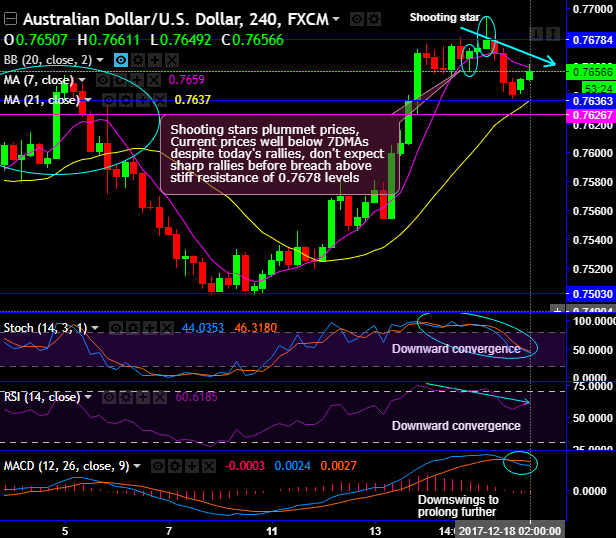

Shooting stars have occurred at 0.7828 and 0.7678 levels on monthly and daily plotting respectively. Hanging man on 0.7670 levels on the daily chart. Consequently, the prices have begun plummeting.

For now, the current prices remain well below DMAs despite today’s rallies.

A cautious near-term bottom formed at 0.7636 levels where we could see strong support at this juncture (refer recent lows on last Thursday), with upside potential for 0.7678 (stiff resistance) if risk sentiment remains elevated or the US dollar slips further.

Please observe at the same juncture, the price behavior has shown a demand zone in the recent history.

On a broader perspective, the bulls managed to break-out channel & range resistance in the months ago, but shooting star has popped up again at 0.7828 levels to counter this move (refer monthly chart). Consequently, the major downtrend has resumed that’s gone back in the same range again by evidencing slumps.

Near-term momentum has still been in bears’ favor and trend indicator still signals downswings to prolong further, same has been the case in the major trend that is converging downwards to signal more slumps on cards in the months to come, both RSI and stochastic curves on monthly plotting indicate selling interests.

Well, overall one could bet on potential dips contemplating snapping deceptive rallies, thus, we reckon that it is wise snap rallies to bid tunnel spreads options strategy to speculate this pair for leveraged yields using upper strikes at 0.7670 and 0.7650 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping below upper strikes before the binary expiry duration.

Alternatively, at spot reference: 0.7659, contemplating lingering bearish indications, on hedging grounds we recommend shorting near-month month futures as the underlying spot FX likely to target southwards in near run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 82 levels (which is bullish), while hourly USD spot index was at 37 (bullish) while articulating at 05:25 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: