The pound rallied to the highest levels this year against both the US dollar and the euro, following the PM’s statement yesterday. GBPUSD and GBPEUR increased to highs of 1.3288 and 1.1678. But the geopolitical risk events continue to linger as the PM, though, said that a potential Brexit delay is likely to be a one‑off, indicating that there could be a new cliff edge in June – unless parliament votes in favor of a revised deal in two weeks’ time.

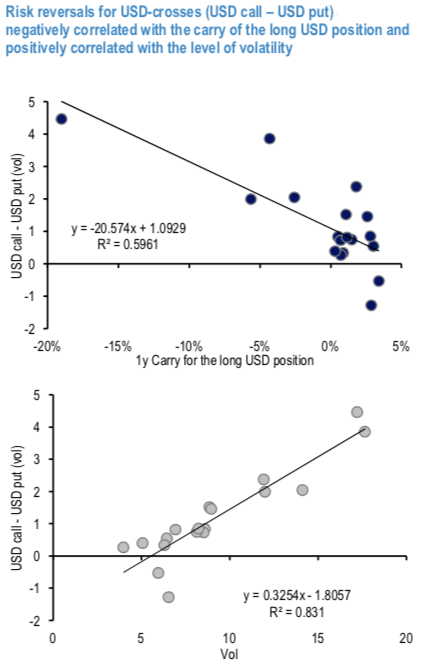

We propose a screening framework for assessing the valuation of risk-reversals relative to forward points and volatility levels, for each currency pair.

This analysis is carried out both cross-sectionally, across G10 and EM currencies, and over time, and results are broadly consistent with each other.

Over the past few months, on several occasions, we have reviewed the interplay between risk-reversals and carry (forward points), for both speculative and hedging purposes (for instance, EM vol has peaked for now). By screening for systematic relative-value opportunities in the riskies vs. forwards space, we try to explicitly isolate the carry component which could be embedded in risk-reversal prices. The topic is particularly relevant at a time when EURUSD forward points are at a historic all-time high, which increases the interest of looking for derivatives-based strategies for hedging long USD cash positions.

We begin by carrying out a cross-sectional analysis, by comparing market parameters as of today. We focus on a set of liquid USD- G10 and EM crosses. Regardless of the market convention on each currency pair, we store risk- reversals in the format of (3M, 25delta) USD call – USD put, in vol points; similarly, we store the carry (in %, annualized, from the 3M forward) corresponding to the long USD/CCY position, and 3M ATM vols.

In the above chart, we refer to the JPM’s analysis, wherein, the current relationship between USD riskies and the carry embedded in long USD positions, across the 18 pairs considered. There is a clear, negative correlation between the two sets of assets, i.e. wider carry calls for a more negative skew. For the high-carry / high-beta assets, this is understood as the need for hedging via options positive carry positions as implemented in the cash market. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 150 (which is bullish), while hourly USD spot index was at -123 (highly bearish) while articulating (at 12:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?