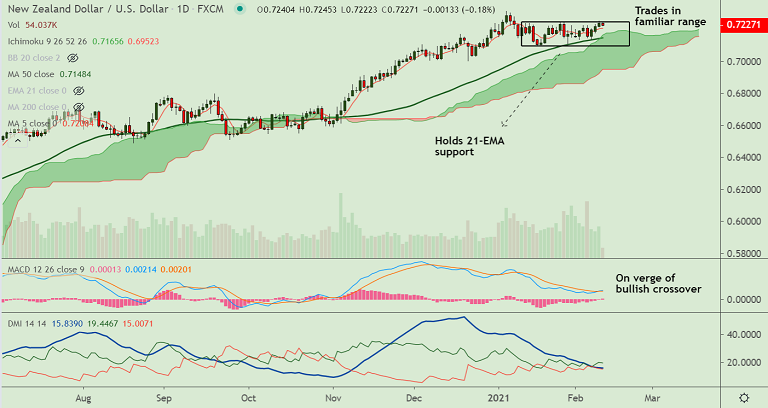

NZD/USD chart - Trading View

NZD/USD was trading slightly weaker on the day (down 0.14%) at 0.7229 at around 08:30 GMT.

The pair has paused three consecutive session's of gains, continues to extend sideways in familiar ranges.

Kiwi depressed after comments from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr and weak China inflation data.

China’s Consumer Price Index (CPI) slipped more than 0.0% expected to -0.3%, while the Producer Price Index (PPI) eased below 0.4% market consensus to 0.3% YoY in January.

Kiwi also took clues from RBNZ Governor Orr who said covid risks still remain and expressed concern about housing market.

Major trend for the pair remains bullish, but 200 month MA (0.7189) is stiff resistance and decisive break above required for upside continuation.

Market focus shall be on Powell's speak and U.S. inflation data for impetus. Inflation is expected to remain quiescent in January.

U.S. Consumer Price index (CPI) is forecast to rise 0.3% on the month and 1.5% on the year. Core CPI is projected to add 0.2% and 1.5% respectively.