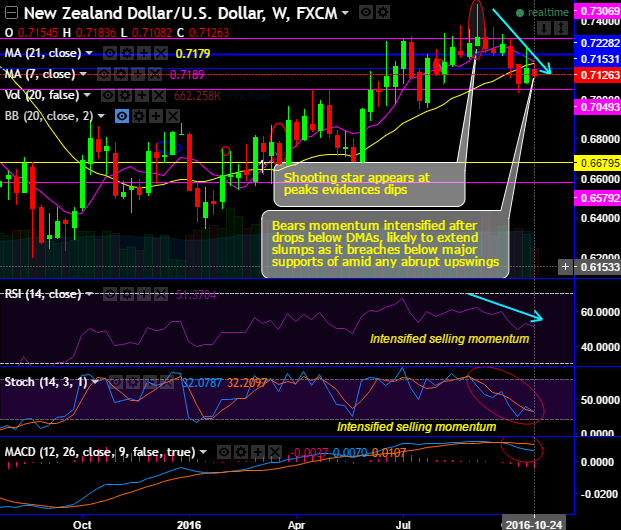

In our recent technical write up on this pair, we’ve already stated the formation of shooting star candlestick patterns at peaks of 16-months highs which is bearish in nature (at 0.7318 levels on weekly chart and 0.7282 levels on monthly terms).

Please note that this bearish pattern has occurred at 50% Fibonacci retracements from the bottoms of 0.6196 levels.

These occurrences of shooting stars at peaks evidence considerable price declines both weekly and monthly terms.

On weekly charts, the NZDUSD’s bearish momentum has been intensified after drops below SMAs, likely to extend slumps as it breaches below strong supports of 0.7228, 0.7184 (38.2% Fibos) and 0.7150 levels, for now, the breach below 21SMAs is also on the cards.

On monthly terms, 16-months high tests resistance at 0.7485 and rejects since then, attempts to slide below EMAs. Thereby, one can infer that the consolidation pattern is now sensing the weakness.

Ever since the pair has rejected 16-months highs at 0.7485 and kept tumbling, attempts to slide below 7EMA (see monthly charts), Kiwi dollar seemed like exhausted at this juncture from the last couple of weeks but for now “Shooting Star” pattern occurred to signify weakness.

To substantiate this stance, RSI and Stochastic oscillators on both weekly and monthly graphs are suggestive of further declines as they evidence downward convergence to the price dips, so previous consolidation pattern now seems to have exhausted at this level ahead of central banks monetary policy changes in both NZ and the US continents.

While %D crossover at 80s which is overbought zone on monthly plotting have been convincing that the selling momentum is still strong. Weekly MACD is also substantiating the same as the downtrend likely to prolong.

Hence, considering above technical reasoning, one can eye on fresh short build ups snapping every rally for targets of 0.7049 and 0.6946 levels upon breach of the 1st target, maintain a strict stop loss of 0.7306 levels.