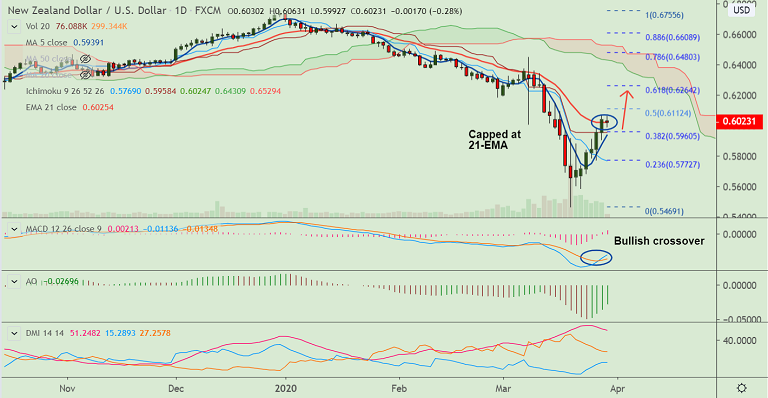

NZD/USD chart - Trading View

NZD/USD trades comatose around 21-EMA resistance, technical bias still supports upside.

The major was trading 0.26% lower at 0.6024 at around 04:00 GMT, with session highs at 0.6063 and lows at 0.5992.

Market’s risk-tone remains under pressure. PBoC's rate cut and the liquidity injection have failed to put a bid under the risk assets.

US dollar is drawing safe-haven bids, while the Kiwi under pressure after RBNZ indicated readiness to take further measures to combat the COVID-19 pandemic.

The Reserve Bank Of New Zealand (RBNZ) said the central bank has other tools on hand to keep cost of borrowing low for as long as needed.

NZD/USD has paused 6-day winning streak. But, technical indicators still support upside. Major trend is bearish, but break above 21-EMA could see more upside momentum.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) to limit upside. Rejection at 21-EMA will see downside resumption.

No major data/events scheduled for the day. Focus remains on the virus/stimulus news for direction.

Major Support Levels - 0.5960 (38.2% Fib), 0.5938 (5-DMA)

Major Resistance Levels - 0.6025 (21-EMA), 0.6112 (50% Fib)

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential