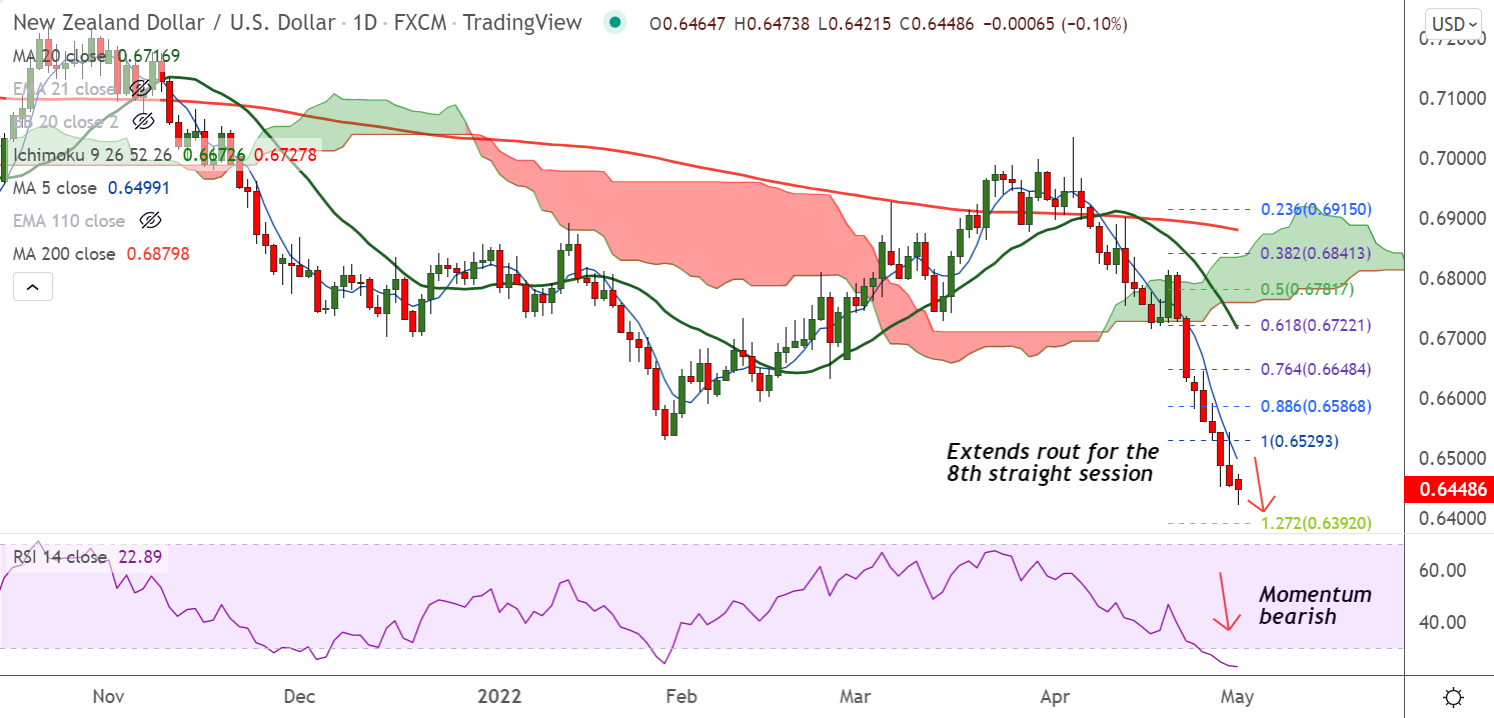

Chart - Courtesy Trading View

NZD/USD was trading 0.12% lower on the day at 0.6447 at around 09:20 GMT.

The major is extending bearish streak for the 8th consecutive session, outlook bearish.

Uncertainty ahead of the Fed monetary policy announcement has strengthened the negative market sentiment, denting the antipodeans.

Friday's release of the March Personal Consumption Expenditure (PCE) Price Index remained supportive of elevated US Treasury bond yields.

US Treasury yields regained upside momentum amid hawkish Fed expectations, supporting the greenback.

Further, fears of global economic slowdown and inflation boom, add to the US dollar’s safe-haven demand.

Focus now on US ISM Manufacturing PMI for April, expected at 58.0 versus 57.1 prior, for short-term directions.

Technical bias is bearish. Little support seen till 0.6392 (127.2% Fib). Next major support lies at 161.8% Fib at 0.6217.