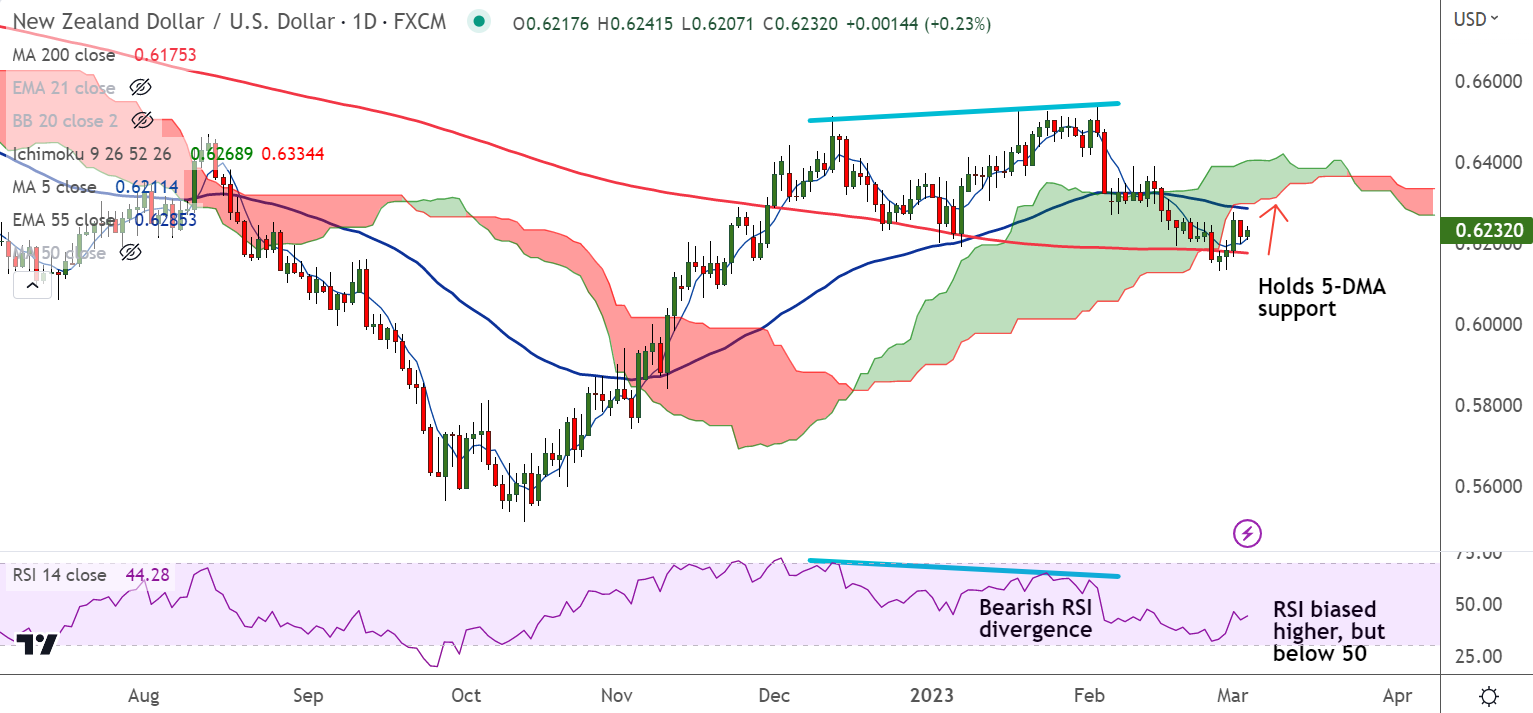

Chart - Courtesy Trading View

NZD/USD was trading 0.18% higher on the day at 0.6229 at around 10:35 GMT. The pair has paused downside and bounced off 200-DMA support.

Return of risk appetite following comments by Atlanta Fed President Raphael Bostic help support the antipodeans.

Bostic said on Thursday that the impact of higher U.S. interest rates on the economy may only begin to "bite" in earnest this spring, an argument for the Fed to stick with "steady" quarter-point rate increases.

Bostic's dovish comments came despite unemployment claims data on Thursday pointed to a still strong U.S. jobs market and other data showing a revised jump in labour costs at the end of last year.

Focus now is on China's annual parliament session on Sunday when Beijing will set its economic goals for the year and unveil fresh policy support to consolidate an economic recovery.

US Services PMI data due at 1445 GMT later in the NY session will influence price action. Upbeat US Services PMI could fuel hawkish Fed bets.

US Services PMI is seen lower at 54.5 from the former release of 55.2. The New Orders Index which conveys the forward demand is expected to decline to 58.5 from the prior figure of 60.4.

Support levels:

S1: 0.6211 (5-DMA)

S2: 0.6175 (200-DMA)

Resistance levels:

R1: 0.6263 (21-EMA)

R2: 0.6285 (55-EMA)

Summary: NZD/USD nascent recovery attempts find next major resistance at 21-EMA. Series of resistance seen till 0.6285, break above will see further upside in the pair.

On the flipside, failure to hold above 200-DMA negates any upside bias. Scope the for test of fresh multi-month lows below 0.6131.