Bears break below strong support at 0.7416, bearish engulfing pattern candle has occurred at 0.7414 levels.

Although there has been lingering bullish sentiment in the short run, the ongoing rallies are unlikely to show stern moves above 0.74 levels as the leading indicators (RSI and stochastic curves) signal shrinking momentum at this juncture.

Failure swings at the stiff resistance of 0.7431 levels (21SMA), more slumps are expected upon bearish SMA crossover and clear downward convergence on leading oscillators (on 4H charts).

For now, expect more slumps upon the bearish engulfing pattern and bearish SMA crossover.

Fundamentally, China in the recent past managed to produce an upbeat CAIXIN manufacturing PMIs, the data has outpaced the forecasts, actual 50.3 versus forecasts at 49.9 and the previous flash of 49.6.

Since China has been the major trade partner of New Zealand and the Kiwis’ trade exposure towards China is considerable, we would like to shed some light on Chinese macroeconomic numbers.

The Relative Strength Index (RSI) technical indicator, which compares the magnitude of recent gains with the magnitude of recent losses, is used by chart watchers to gauge the momentum of a market trend. Bearish convergence is a warning to investors not to buy the dip in the panicky markets, instead, snap the rallies to build tunnel spread like structures.

Any failure swings below 21SMA may attract the trend to slide towards next strong support at seen at 0.74 marks which would mean another 25-30 pips of price dips.

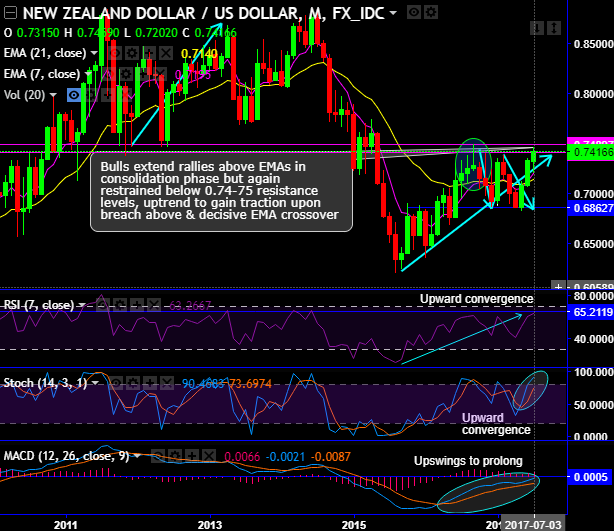

On the flip side, on monthly terms the bullish swings from last three months are gaining traction upto next stiff resistance levels of 0.74-75 levels on the intensified bullish momentum in the consolidation phase in major trend, bulls extend rallies above EMAs in consolidation phase but again restrained below 0.74-75 resistance levels, uptrend to gain traction upon breach above & decisive EMA crossover.

To substantiate this stance, MACD has signaled the continuity in prevailing rallies but remains in the bearish territory (refer monthly charts).

While aggressive intraday speculators can bet on both further upswings upto next stiff resistance levels (maximum upto 0.7431 levels) and thereafter dips seems to be likely.

Trade tips:

Contemplating above technical reasoning, at spot reference: 0.7420 levels, tunnel spreads are the best suitable, so snap the rallies to deploy higher strikes in the binary puts while shorting lower strikes simultaneously. Use upper strike at 0.7431, lower strike at 0.7390 levels which would mean that the speculative opportunity between 40 pips.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 73 levels (which is bullish), while hourly USD spot index was a tad below 11 (neutral) at the time of articulating (at 07:07 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: