- Kiwi weighed by disappointing NZ trade data, NZD/USD drops to fresh weekly lows below 0.70 handle.

- NZ trade deficit narrowed to NZ$18 million for Feb, well below market expectations for a surplus of $160 million.

- Broadly stronger USD on the back of up-move in the US treasury bond yields also adding to downside pressure.

- Focus remains on the outcome of a vote on Trump's healthcare bill, scheduled between 1800-2000 GMT.

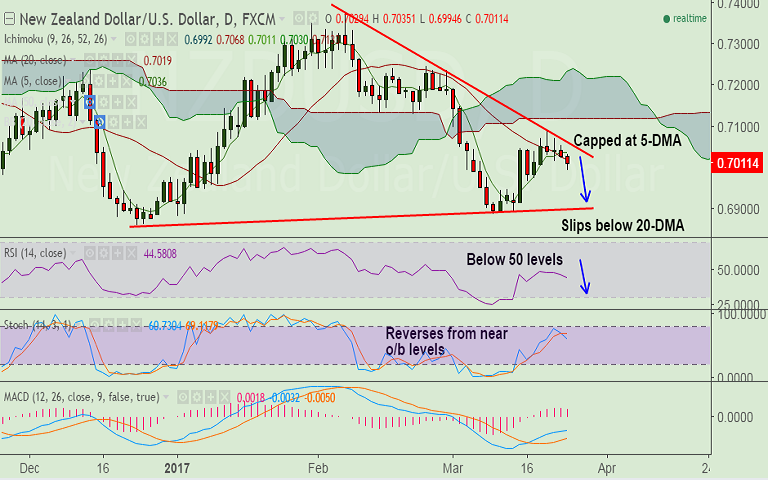

- Technically, the pair has failed to hold break above 20-DMA. Upside also finds stiff resistance at 0.7060 (trendline).

- Upside in the pair has been capped at 5-DMA, RSI and Stochs have turned bearish.

Support levels - 0.6975 (Mar 17 low), 0.69, 0.6890 (March 9 low)

Resistance levels - 0.7019 (20-DMA), 0.7035 (5-DMA), 0.7060 (trendline)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Bearish Neutral

1D Neutral Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 0.7010, SL: 0.7060, TP: 0.6975/ 0.69

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -115.886 (Bearish), while Hourly USD Spot Index was at -63.2094 (Bearish) at 0900 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.