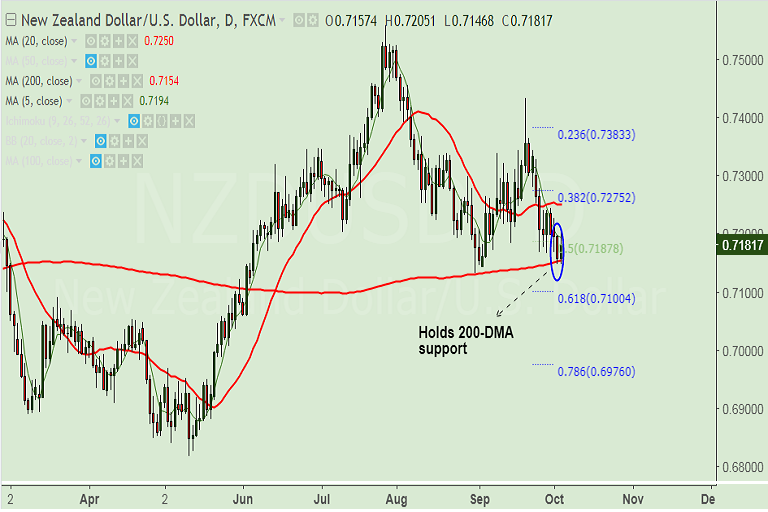

- NZD/USD bounces off 200-DMA support to retake 0.72 handle in early Asia.

- Uptick was supported by broad based US dollar weakness amid looming uncertainty over the next Fed Chairperson.

- The pair failed to hold gains at 0.72 handle, slips lower to currently hover around 0.7175 levels.

- Weaker oil prices and downbeat NZ ANZ job ads data along with steep drop in the dairy prices at GDT auction likely to keep the kiwi under pressure.

- Focus now on US ADP jobs report and ISM services PMI data for further impetus. Fedspeaks will also be watched for fresh insights on the US interest rates outlook.

- 200-DMA at 0.7154 is major support, while 5-DMA at 0.7193 is immediate resistance.

- Close above 5-DMA could see test of 20-DMA at 0.7250, while break below 200-DMA raises scope for test of 0.71 levels.

Support levels - 0.7154 (200-DMA), 0.71 (61.8% Fib retracement of 0.68176 to 0.75580 rally), 0.7057 (June 1 low)

Resistance levels - 0.7193 (5-DMA), 0.7250 (20-DMA), 0.7275 (38.2% Fib)

Recommendation: Watch for clear directional bias.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -133.08 (Bearish), while Hourly USD Spot Index was at -18.2908 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest