China earlier yesterday showed up a disappointing CAIXIN manufacturing PMIs, the data has missed the forecasts, actual 50.3 versus forecasts at 51.4 and the previous flash of 51.2.

On the back of this Chinese data, bulls of NZDUSD are restrained to test the stiff resistances of 0.6968 levels (refer daily charts).

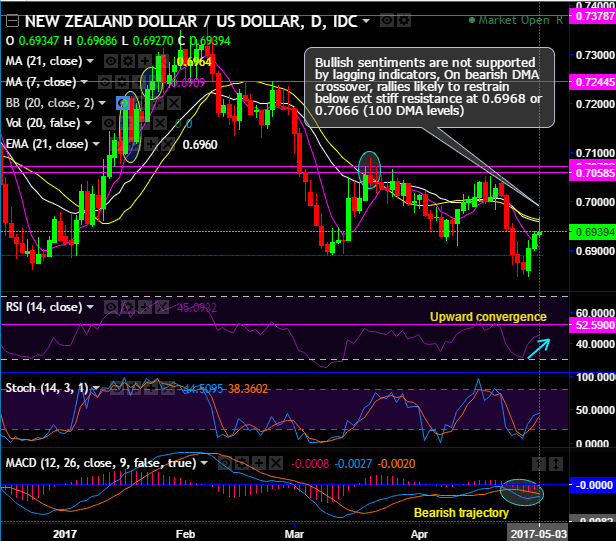

Although there has been bullish sentiment for the day, the ongoing rallies are unlikely to show stern moves above as we’ve traced out bearish DMA crossover, the next stiff resistance is seen at 0.6968 levels.

Most importantly watch for the day, if there is no momentum achieved from the current levels then we foresee most likely shooting star pattern that is likely to resume downswings below 7DMAs again.

On the flip side, on monthly terms despite the bearish engulfing pattern candle bulls have managed to bounce back taking support at double top neckline at 0.6862 levels to ensure the consolidation phase in major trend but again restrained below 0.6968 (i.e. 21DMA) or maximum upto 0.7033 levels (21EMA on weekly), momentum bearish bias (refer weekly plotting).

It has formed double top formation with peak 1 at 0.7485, peak 2 at 0.7375 levels and neckline at 0.6862 levels.

The upswings on this timeframe are likely to restrain below 7EMA, please be advised that more dips seem likely on failure swings at this juncture.

Momentum study: To substantiate the bearish stance available on weekly terms, both leading indicators (RSI & stochastic curves) in conjunction with MACD evidence the bearish convergence that signals strength and momentum in selling interests. While aggressive intraday speculators can also bet on further upswings upto next stiff resistance levels (0.6968 or maximum upto 0.7066 i.e. around 100DMA levels).

Trade tips:

Contemplating above daily bullish sentiment, on trading perspective, it is advisable to buy boundary binaries on dips upper strikes at 0.6988 (20 pips tolerance levels to above stated resistance) and lower strikes at 0.6908 (i.e. 7DMA levels), the strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.