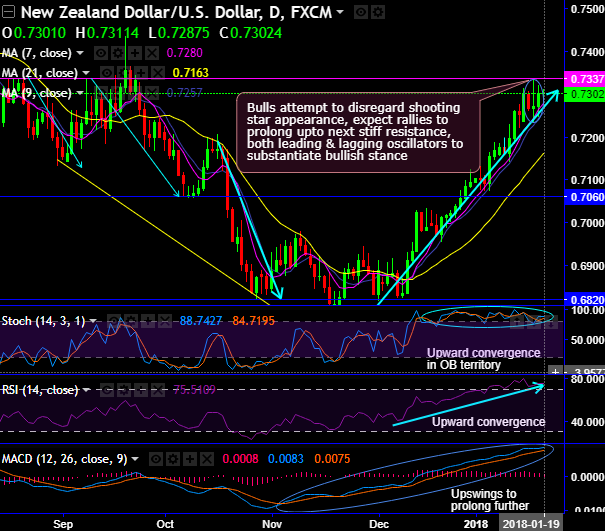

Bears resume in minor trend after the occurrence of shooting star at 0.7272 levels. But bulls seem to be attempting to disregard this bearish pattern (refer daily plotting).

Well, for now, expect rallies to prolong upto next stiff resistance, while both leading & lagging oscillators to substantiate bullish stance.

Next stiff resistance levels are observed at 0.7337 and 0.7499 mark.

The current prices are constantly spiking above 7DMA with bullish DMA crossover.

Both leading oscillators (RSI and stochastic curves) have been converging to the prevailing price rallies to indicate strength and momentum in the uptrend.

While MACD’s bullish crossover also substantiates the extension of upswings.

On the major trend, bullish engulfing pattern candles have countered price slumps from last two months, but don’t jump the guns to conclude this as long term bull trend as the attempts of bull swings were restrained quite frequently below the stiff resistances of 0.7499 levels.

Shooting star and bearish engulfing patterns have rightly placed at this juncture to indicate weakness in the recent history.

But for now, the prices likely to drag and retest these resistance levels as the current rallies spike above EMAs.

Hence, we recommend one touch binary calls for aggressive bulls on trading grounds.

Alternatively for risk averse traders, at spot reference: 0.7301, boundary binaries are advocated with upper strikes at 0.7337 and lower strikes at 0.7279 levels.

This strategy is likely to add magnifying effects to the yields as long as the underlying spot FX remains between these two strikes on expiration.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -15 levels (neutral), while hourly USD spot index was at shy above -41 (bearish) while articulating at 06:21 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: